Ross Young from New Hampshire, USA is a seasoned retail options trader with a conservative, high-probability approach. As a high school teacher in Spanish, he was able to grow his account from $500K to $4M in a few years trading options in between classes. He previously appeared on Theta Profits and returns to share his favorite trade: the Jade Lizard.

Learn all about Jade Lizard here

The video was produced with Streamyard – an easy-to-use and amazing tool for live streaming and recording.

This is Jade Lizard

The Jade Lizard is a multi-leg options strategy that combines a short put and a short call spread. Its main attraction? Zero risk to the upside and a breakeven that’s wider than a simple short put. This makes Jade Lizard an attractive alternative to selling a strangle or an iron condor.

Ross explains:

- The trade starts with selling a put for a desired premium (his preference is around $0.70 or more).

- Then, a tight call spread is added above the current price.

- The total credit received must exceed the width of the call spread to eliminate upside risk.

Example from the video

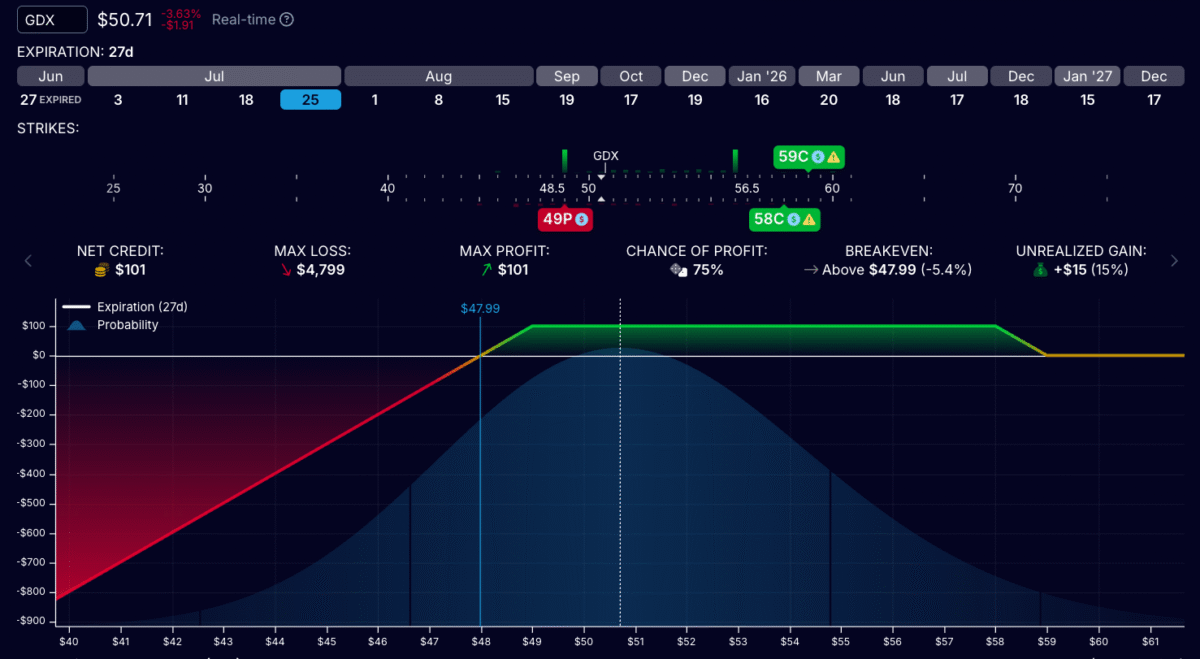

In the video, we use the following example trade:

- Underlying: GDX ETF

- Sold 49 put for $0.79

- Added $1-wide 54/55 call spread for $0.25 credit

- Days to expiration: 45

- Total credit: $1.04 > spread width = no upside risk

In this example, we will make $101 if the price stays between the shorts (49 and 58). The breakeven point is $47.99 and we will start to lose if it moves below that. Above 59, we are, for all practical purposes, breakeven, making $1.

Why Ross trades the Jade Lizard

Ross highlights several reasons this strategy works so well for him:

- No upside risk: Unlike strangles or iron condors, you can’t lose money if the underlying rallies.

- Wider breakeven: The total credit pushes your breakeven lower than the put strike.

- High win rate: With the right setup, win rates can approach 90% over time, according to his experience.

- Fits cautious trading style: Ross prioritizes safety and steady income over big, risky bets.

He typically trades Jade Lizards on liquid ETFs with high implied volatility and low share prices, like GDX or GDXJ.

How to manage the Jade Lizard trade

Ross offers several tips on managing the position:

- Take profits at 50% if possible

- Let winners play out when price stays within range

- Roll calls down if price drops — this adds credit and improves breakeven

- Avoid rolling the put up unless you are fine with a higher breakeven

- Roll the entire structure out in time if IV stays elevated

He recommends treating it as one complete trade, not as isolated legs.

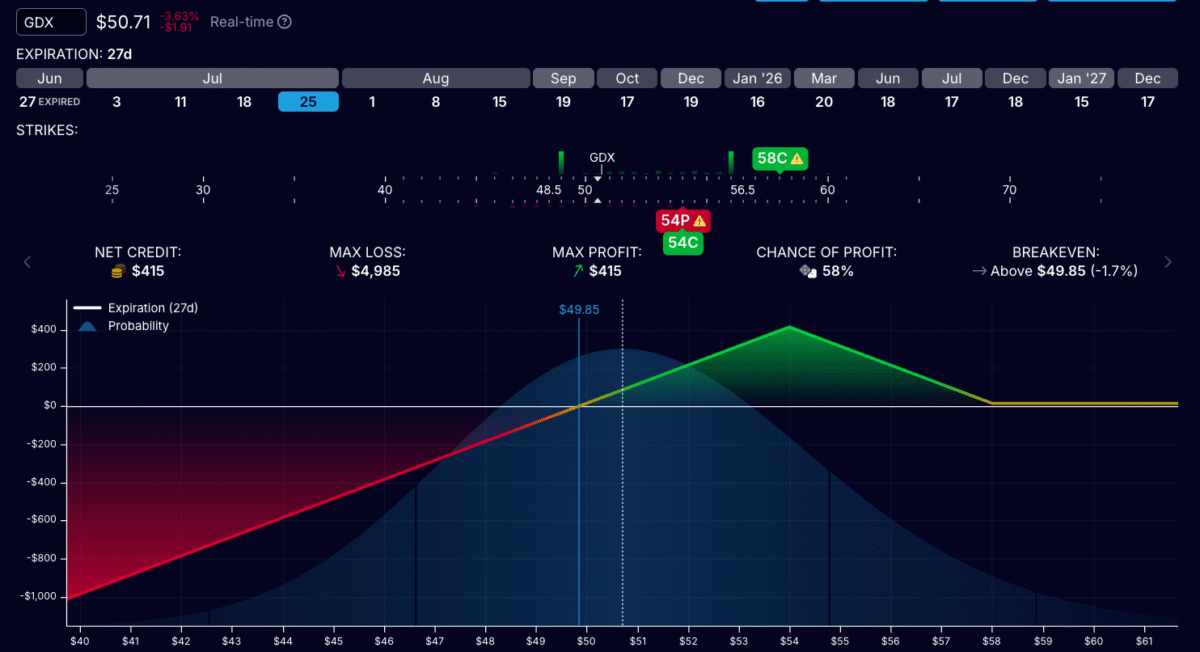

Big Lizard: The sibling

Ross also introduces the Big Lizard, a variation where both the short put and the short call are at-the-money, creating a straddle. A long call caps the upside risk.

This version:

- Takes in more credit than the Jade Lizard

- Has less room to the downside

- Works better if you want fewer contracts and a bigger payout

Ideal market conditions for Jade Lizard

Both Jade and Big Lizards thrive in these conditions:

- Elevated implied volatility (IV)

- Liquid, low-to-mid-priced underlyings

- Neutral to bullish bias (sideways movement is ideal)

Ross often sets them up with 45 days to expiration and avoids illiquid or wide-strike products.

You may also like these options strategy videos:

- Double Calendars with Ravish Ahuja

- Broken Wing Butterfly with Carl Allen

- Time Flies Spread with Simon Black

- 0DTE Iron Fly with Dale Perryman

Final tips from Ross Young

- Know your downside risk and avoid over-sizing.

- Keep the call spread narrow to maintain zero upside risk.

- Use these strategies when you’re unsure but slightly bullish.

- Only roll if it improves your position — don’t roll out of hope.

Where to learn more

Ross recommends Liz & Jenny on Tasty Live, the original creators of the Jade Lizard. For more on Ross’s approach, check out his previous interview on our YouTube channel.

Jade Lizard: Frequently Asked Questions (FAQ)

This is Jade Lizard

The Jade Lizard is an advanced options trading strategy that combines a short put and a short call spread on the same underlying asset. It’s designed to profit from neutral to slightly bullish price action, with no upside risk if the total credit received exceeds the width of the credit spread. The goal is to collect premiums from both sides while avoiding losses if the stock moves higher.

A Jade Lizard involves selling:

1. One out-of-the-money (OTM) put

2. One OTM call

3. Buying one further OTM call (creating a call spread)

This setup creates a position where maximum profit is the total premium collected, and maximum risk is to the downside if the stock drops below the put strike. If constructed properly, there is no risk to the upside, making it an appealing investment during periods of low volatility or slightly bullish markets.

There’s no upside risk if the premium collected is greater than the width of the call spread. This means even if the stock price rises sharply, the long call covers your short call, and the total credit more than offsets the worst-case loss from the call spread. Traders often check this ratio before entering the trade to ensure the “no upside risk” condition is met.

The Jade Lizard works best when:

– Implied volatility is high, especially on the put side

– You are neutral to slightly bullish on the underlying

– The underlying is liquid

The main risk with a Jade Lizard is on the downside, where losses can occur if the stock falls sharply below the short put strike. Like all net short premium trades, it’s also exposed to volatility spikes and gap moves. Proper position sizing and risk management — such as using stop-loss levels or rolling the trade — are key to avoiding large losses.

[…] Jade Lizard: Combining a short put with a call credit spread to create a flexible, no-upside-risk trade. […]

[…] Jade Lizard explained: No upside risk […]

[…] Ross Young: Jade Lizard options strategy explained: No upside risk […]