Here is an options trading strategy, called Flyagonal, that tries to benefit whether the volatility in the market goes up or down. Steve Ganz, an experienced options trader and educator, has named his strategy Flyagonal. The name plays on the fact that it is a combination of a butterfly trade and a diagonal, hence Flyagonal.

Flyagonal is still a strategy under development. However, after 60 trades and two months of live trading, Steve has achieved a win rate of 96% and earned $24,000 using this strategy alone.

Learn all about Flyagonal in this video

The video was produced with Streamyard – an easy-to-use and amazing tool for live streaming and recording.

Steve Ganz

Steve Ganz is a veteran options trader and educator who has worked with Option Alpha, OptionStrat, and Online Trading Academy. He also runs an alert service for options traders, and has his own YouTube channel.

What is the Flyagonal strategy?

The Flyagonal is a hybrid options strategy that combines two powerful trades: a call broken wing butterfly and a put diagonal. The goal is to:

- Generate positive theta (time decay)

- Cover a wide range of market movements

- Manage volatility risk.

- Stay defined-risk at all times

Flyagonal is similar to Simon Black’s Time Flies Spread, which we have presented earlier. Steve and Simon trade it a bit differently, though, and if you find this strategy interesting, I do recommend that you also watch the interview with Simon.

How the Flyagonal works

Flyagonal is an advanced options trading strategy that combines two trades.

1. Call broken wing butterfly

The strategy starts with a call broken wing butterfly, placed above the current price. It benefits from:

- Moderate upward price movement

- Time decay from the short calls

- Decreasing volatility

2. Put diagonal

The second leg is a put diagonal, placed below the current price. This is a so-called time spread, with the short put closer in time and with a higher strike than the long put. This leg profits from:

- Price drops

- Volatility spikes

- Positive time decay spread across dates

Combining the two trades

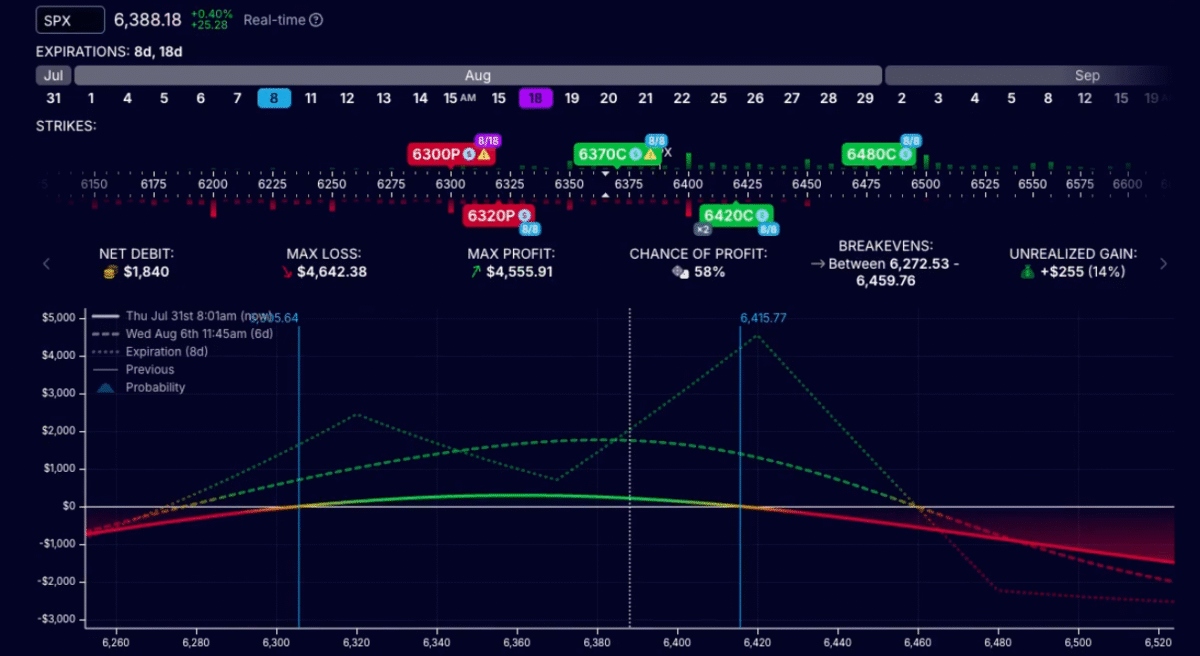

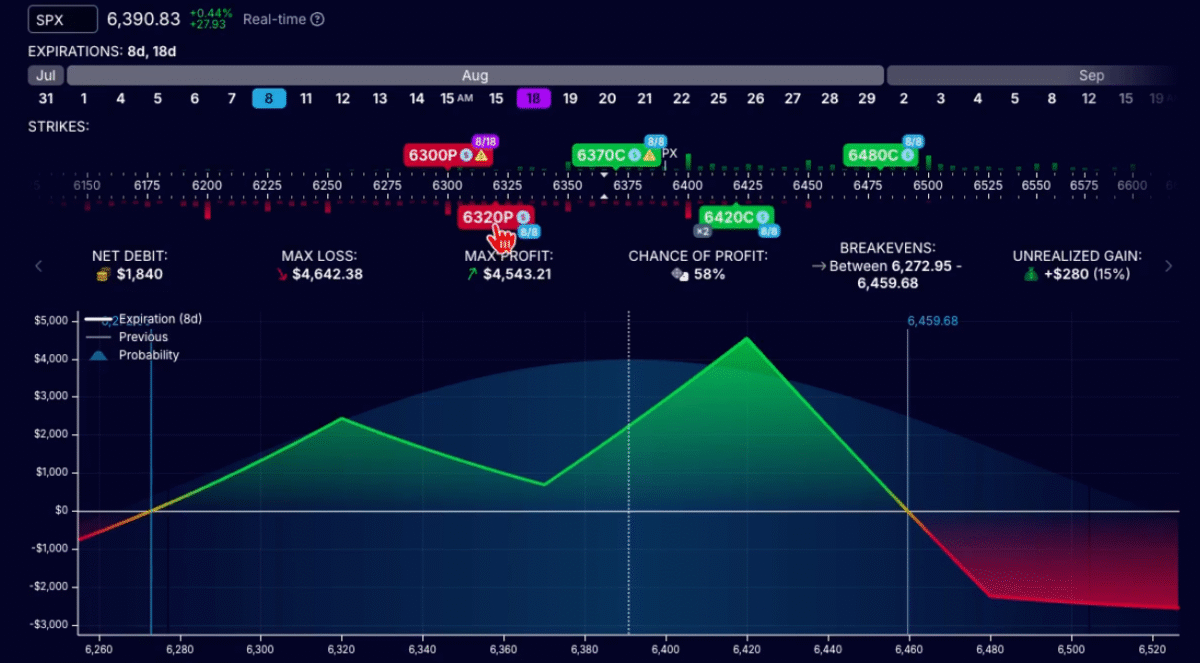

Steve typically sets up the trade with 8 – 10 days to expiration for the call broken wing butterfly and the short put, while the long put is set at the double days of expiration, typically 16 – 20 days. He uses 3% as a starting point for how far from the current price the shorts in both trades are placed.

When both legs are in place, the Flyagonal creates a tent-like payoff profile with a wide profitability range — typically 200+ points wide in SPX. The trade is designed to be resilient across:

- Flat markets (theta decay)

- Rising markets (butterfly wins)

- Falling markets (diagonal wins from both price and volatility)

A key characteristic of the trade is how it reacts to changes in volatility. The put diagonal has positive vega, while the call broken wing butterfly has negative vega. This means that spikes in volatility, which typically happen when the market drops, will benefit the put diagonal. If the volatility drops, typical for a market going up, the call broken wing butterfly will get an extra boost. In this way a Flyagonal has a kind self-adjustment built into it.

Strategy setup and rules

Here is a summary of Steve’s mechanics for the trade.

- Underlying: Mostly SPX, but also tested on RUT, QQQ, TSLA, NVDA

- Short leg: 8–10 DTE

- Long leg: 2× DTE of the short leg (typically 16–20)

- Profit target: ~10% of max loss

- Hold time: 3–5 days. Steve never holds the trade to expiration.

- Adjustments: Rare; usually a simple roll of a short leg

Live trading results

Steve has tracked 60 Flyagonal trades live, with the following stats:

- 58 wins, 2 losses

- $24,000+ in profit

- ~10% average return per trade

Who the Flyagonal is suited for

The Flyagonal is best suited for intermediate to advanced retail options traders, according to Steve:

- Traders familiar with butterflies, calendars, or diagonals

- Those looking for a consistent income

- Anyone who prefers defined-risk trades with flexible mechanics

This is not a beginner strategy, but it’s highly teachable to traders who have experience with verticals and multi-leg spreads.

Where to learn more

Steve offers extra information about the Flyagonal strategy on his website.

Also, check out our interview with Simon Black, who also combines a call broken wing butterfly and a put diagonal, but with slightly different mechanics.

Hello

I am interested in the Flyagonal method and I have been Trading Ics on the spx,the problem is I make $1 but the Max loss sometimes wipes out my profit.

What is the Trading capital you need to test out this strategy.

Hoping tp hear from you soon

Regards

Sk

[…] With Steve Ganz: Flyagonal – how a hybrid options strategy hit a 96% win rate […]