The US dollar has dropped significantly in value during the first half of 2025. For non-US options traders, this can pose a big currency risk.

But stop for a bit: You don’t have to convert your local currency into USD to trade US options, explains my interview guest Christian Czirnich, a German lawyer and trader. He has found a way to eliminate currency risk in his options trading.

Learn how Christian eliminates his currency risk in this video

The video was produced with Streamyard – an easy-to-use and amazing tool for live streaming and recording.

Christian Czirnich

Christian Czirnich is a lawyer and experienced retail trader based in Germany. With a background in stocks, forex, and futures, he has focused exclusively on options since 2019. He has previously appeared on Theta Profits in an interview about how he sets up trades with no risk of loss at expiration. This is one of the most popular videos on our channel so far.

Why currency risk is a problem for non-US traders

If you’re trading US options from outside the country, you’re exposed to foreign exchange risk. When the US dollar weakens against your local currency, your trading profits shrink when converted back. You may even lose money despite a winning trade. According to Christian, “You need first to earn the currency differential before you make any profits at all.”

The simple solution: Don’t convert currency

Christian’s solution is straightforward: don’t convert your local currency into US dollars. Instead, keep your trading capital in your home currency and use strategies that allow you to access USD without conversion.

Christian uses a broker that supports multi-currency accounts, specifically Interactive Brokers. This allows him to hold and post a margin in euros while trading US options. Here’s how he eliminates most of his currency exposure:

- Use credit spreads or similar option strategies that result in an upfront credit in USD.

- Post margin in local currency; no conversion is needed.

- Avoid debit trades or use credit trades to generate the USD needed to fund them.

When you trade options, your broker requires margin, essentially a security deposit. Christian explains that some brokers, for instance, Interactive Brokers, accept local currency for margin, so there’s no need to convert your trading capital.

- You may also like these videos:

Using SPX short boxes for USD liquidity

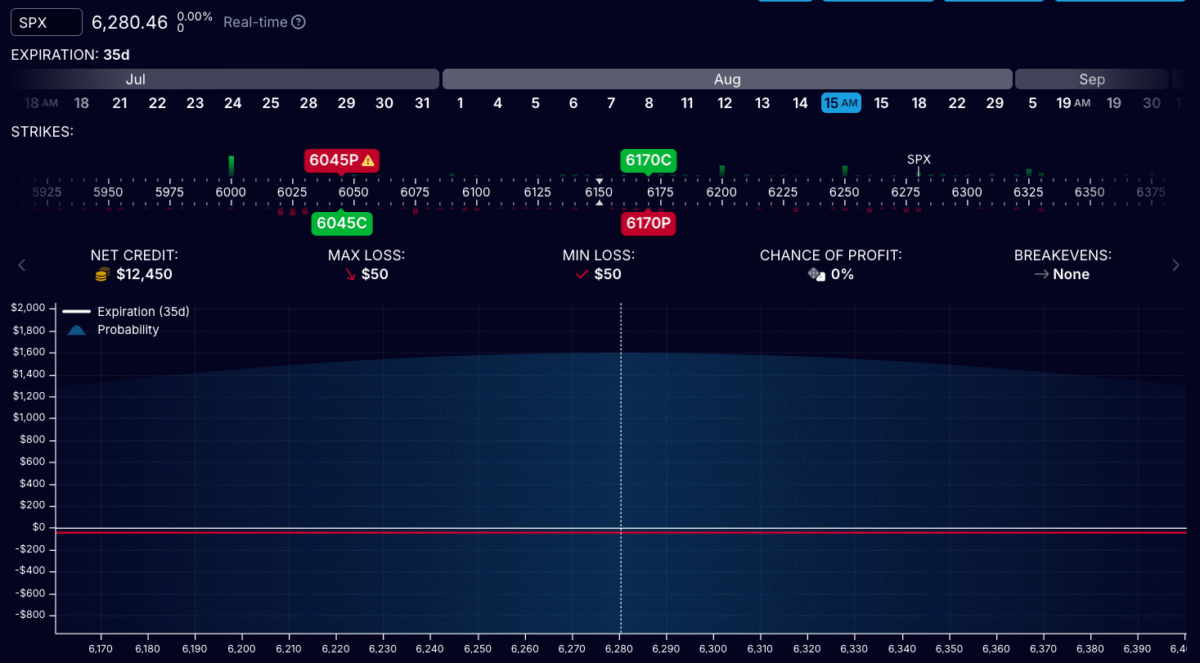

To generate large amounts of USD without converting euros, Christian sets up a structure known as a short box on the SPX index. This gives him an upfront credit (like a loan) which he can use for other trades or to buy U.S. assets.

- A short box is made by combining a call credit spread and a put credit spread where the strikes match each other (the short call has the same strike as the long put – and vice versa).

- The credit received can be substantial, depending on the structure.

- The cost is essentially the interest, often comparable to or lower than margin rates from brokers.

Benefits for US traders too

This approach isn’t only for international traders. US-based traders paying high broker margin rates (e.g. 10% or more) can also benefit by setting up SPX short boxes, effectively borrowing at closer to the federal funds rate (~4%). Similar structures can be used to access the local currency if you like to trade in a foreign market.

Summing up: Christian’s key advice to avoid currency risk

Currency risk is often overlooked but can be a major drag on returns for non-U.S. options traders. With the right broker and strategy, you can reduce or even eliminate this risk and focus on trading performance, not currency swings.

- Keep your trading capital in your home currency.

- Use options strategies that generate USD credits.

- Use SPX short boxes to access large USD amounts if needed.

- If you want exposure to another currency, trade it intentionally via futures or options.

Book recommended in this video

- John C. Hull: Options, Futures and Other Derivatives