The Wheel is one of the most popular options trading strategies, and is often recommended to beginners. But it has one big challenge: it can hurt in a big move down in the market. This caused Karl Domm to develop the Safe Wheel strategy, which adds hedges both on the put and the call side.

Learn the Safe Wheel Strategy in this video

Karl Domm

Karl Domm is an experienced trader, registered investment advisor, author of two books on options, and founder of the Real P&L YouTube channel. He focuses on building transparent, rules-based strategies for retail traders. Karl lives in Bakersfield in California, USA.

Why the Wheel strategy is so popular

The wheel strategy is one of the most well-known options trading approaches. Traders sell puts to collect premium, and if assigned, they sell covered calls until the shares are called away. This creates a cycle—or “wheel”—that generates income from option premium.

But the wheel has a big drawback: if the stock drops significantly, traders can get stuck holding shares at a higher basis. At that point, selling covered calls becomes difficult without locking in a loss.

- Other videos you may like:

- Levi Woods: The Wheel options strategy with a twist

- Lance Kaminsky: Covered strangle

- Karsten Jeske: How options trading can supercharge early retirement

The problem Karl wanted to solve

Karl recognized that many beginners love the wheel but often run into its downsides:

- Unlimited downside risk if the stock drops hard

- Oversized positions when traders start small accounts

- Getting “stuck” with shares they can’t sell calls against

His solution? Build a hedge directly into the wheel while keeping the system simple enough to learn with real money.

How the Safe Wheel strategy works

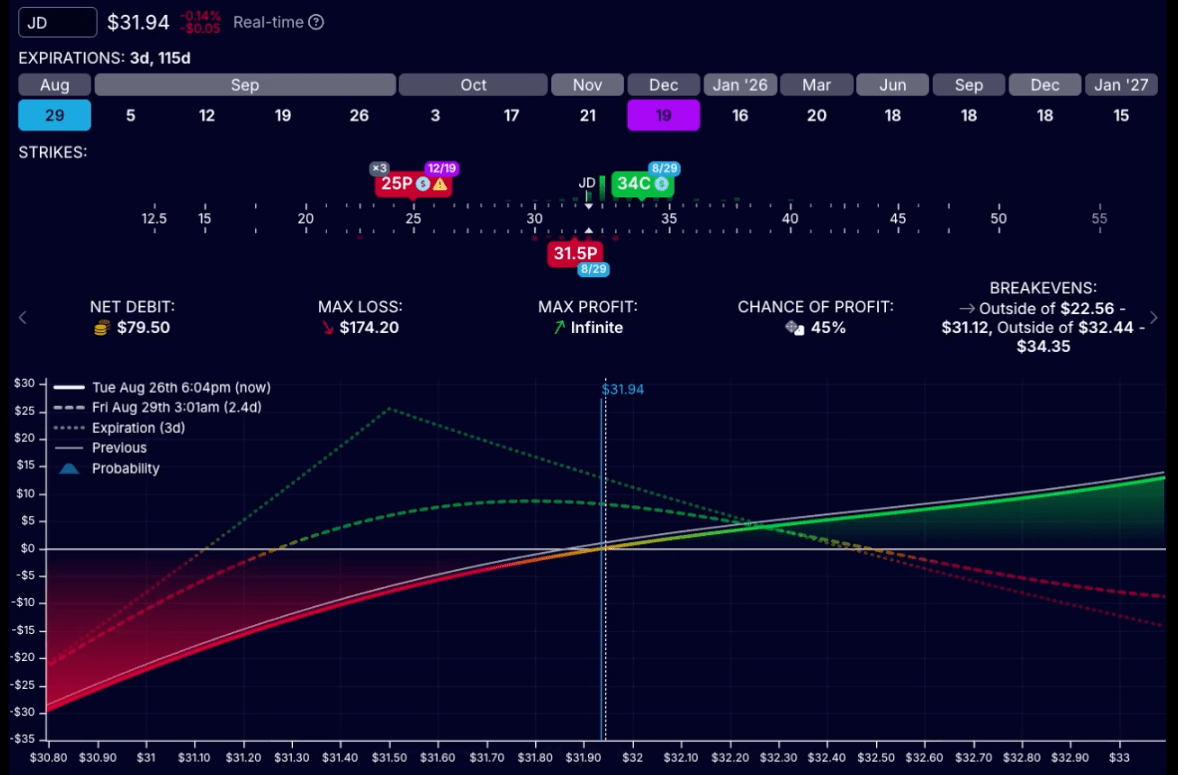

Karl’s Safe Wheel introduces protective hedges to reduce risk:

- Built-in hedges: He buys three long puts far out-of-the-money (150-200 days to expiration) to cover downside risk. The puts are bought at a strike price that is about 80% of the current market price.

- Extra upside protection: A cheap (5 cents) weekly long call to cover surprise rallies.

- Always be collecting: Each week, he sells puts or covered calls, aiming to collect at least 1% of the stock price in premium.

- Tier two adjustment: If the stock drops and he gets stuck, he can open a second wheel position, still protected by his hedge.

The system is rules-based and requires only 10–15 minutes per week. It is always managed on Mondays and Fridays. Watch the video for a more detailed walk-through. You may also consult Karl’s flowchart that lays out which decisions to make when.

What makes the Safe Wheel unique

According to Karl, the Safe Wheel Strategy is not designed to beat the market in bull runs. Instead, it’s best suited for:

- Beginners who want to learn with real money but avoid major blowups

- Safety-focused traders who value protecting capital first

- Sideways or down markets, where the hedge helps reduce drawdowns

Karl rates the risk of the Safe Wheel at about 2.5 out of 10, roughly half the risk of just holding the S&P 500.

Results so far

Karl has tracked Safe Wheel performance since 2022:

- 2022: +21.7% (while S&P 500 was -19.5%)

- 2023: +5.4% (S&P 500 +24.3%)

- 2024: -14% (S&P 500 +23%)

- 2025 YTD: +1.35% (S&P 500 +10%)

Overall, the Safe Wheel has underperformed the market in strong up years, but with smaller drawdowns and lower overall risk. On a risk-adjusted basis, Karl argues it holds up well as a learning tool and diversification strategy.

Is the Safe Wheel strategy right for you?

If you are looking for a strategy to generate the highest possible returns, the Safe Wheel isn’t the answer. But if you want:

- A structured, rules-based way to learn options

- A lower-risk system compared to the classic wheel

- Weekly consistency with clear hedging rules

…then the Safe Wheel may be a great fit.

Karl himself only commits a small account to the Safe Wheel. For larger accounts, he uses other more advanced systems. But for beginners and safety-first traders, the Safe Wheel is a unique entry point into options trading.

Where to learn more

Karl offers his Safe Wheel Strategy course for free, and you can also follow him on his Real P&L YouTube channel where he shares weekly trade updates.

Books recommended in this video

Admitting he is biased, Karl recommends that options traders read his latest book:

- Karl Domm: All Market Trading Profits

He also recommends a popular investment book:

- Burton G. Malkiel: A Random Walk Down Wall Street

[…] money work for you, even when the market isn’t making huge moves. You can find more about the Safe Wheel Strategy if you’re looking for a beginner-friendly […]

[…] Karl Domm: The Safe Wheel Strategy […]