Ravish Ahuja has earlier shared how he trades his double calendar strategy. But at the same time, he emphasized that most of his trading capital, 80%, is allocated to low-risk options strategies. In this video, he shares two of those strategies.

Learn two low-risk options strategies in this video

The video was produced with Streamyard – an easy-to-use and amazing tool for live streaming and recording.

Ravish Ahuja

Ravish Ahuja is a former fintech professional who transitioned into full-time options trading in 2022. He lives in New Jersey in the USA, and recently started sharing his methods through his own YouTube channel.

Why focus on low-risk options strategies?

Most traders are attracted to options because of the potential for huge profits. But with high reward often comes high risk.

Ravish takes a different approach: he allocates 80% of his portfolio to low-risk options strategies designed to protect his capital while still generating strong returns. The remaining 20% he uses for high-reward trades, such as double calendars.

He says that this 80/20 “barbell” approach allows him to trade with confidence, reduce stress, and still benefit from significant upside.

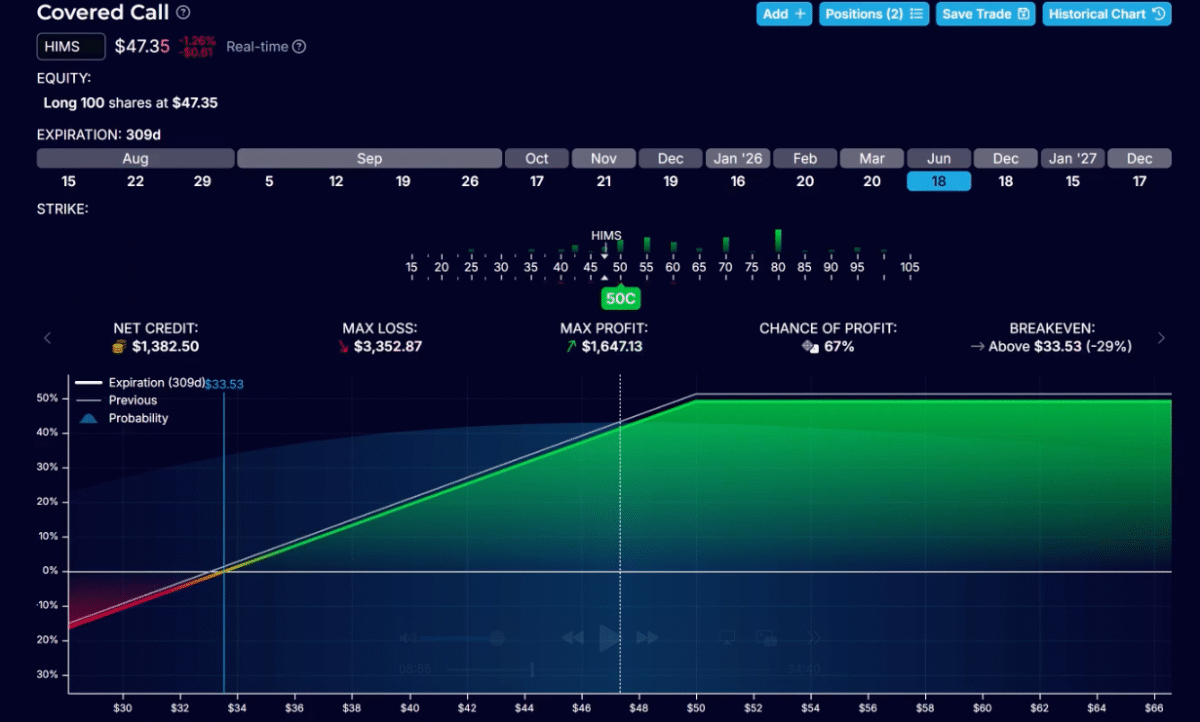

Low-risk options strategy 1: LEAPS covered calls

One of Ravish’s core approaches is selling LEAPS covered calls:

- Instead of selling short-term calls (weekly or monthly), Ravish sells long-term calls, known as LEAPS, with expirations ranging from 6 to 24 months.

- He chooses high-quality stocks or ETFs he would like to hold long term.

- By selling at-the-money LEAPS calls, he collects significant premium upfront.

Benefits:

- Downside protection: Some setups can protect against a 25–30% drop in the stock.

- Consistent returns: Even if the stock stays flat, he can generate 20–40% returns.

- Set and forget: Trades require little day-to-day management, making them stress free.

Ravish reports having placed hundreds of these trades without a single loss.

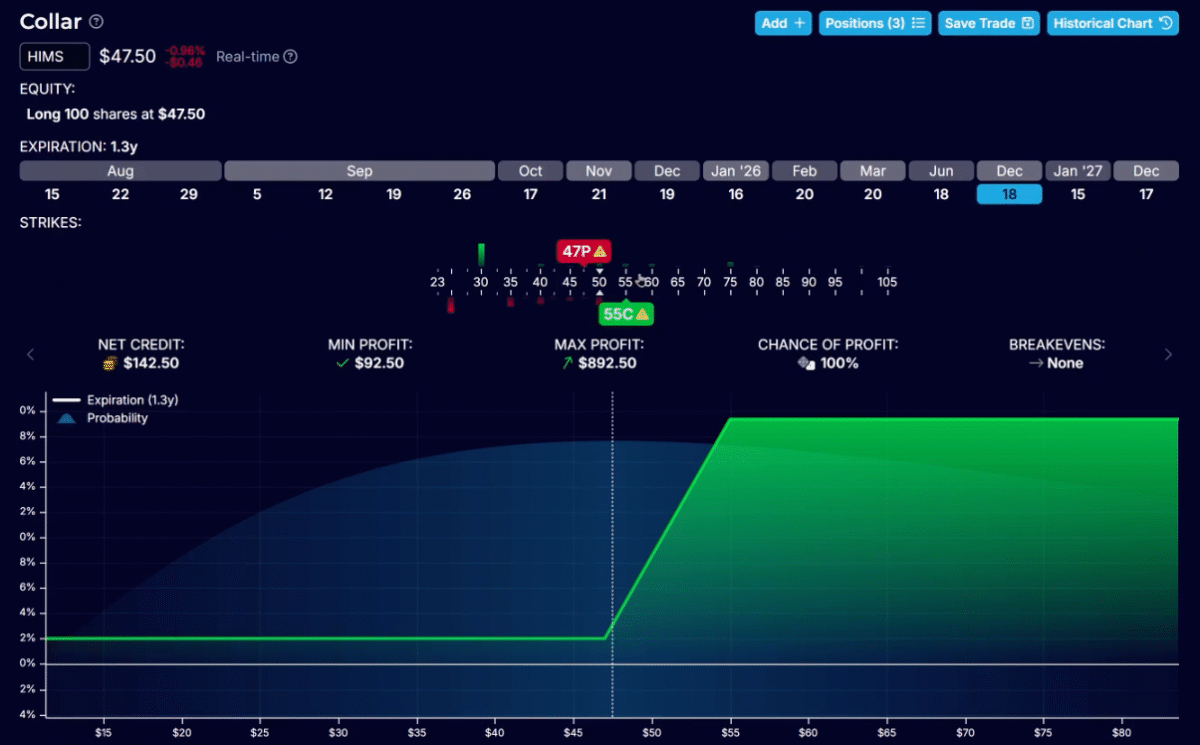

Low-risk options strategy 2: Collar with a twist

The second strategy Ravish uses is a variation of the collar strategy:

- Buy 100 shares of stock.

- Sell a covered call to collect premium.

- Use that premium to purchase a protective put.

This creates a defined risk profile where downside is limited and upside is capped. Ravish enhances this by taking advantage of pricing discrepancies between calls and puts in long-term options. In some cases, he structures these trades so that they are effectively zero-risk setups.

Benefits:

- Asymmetric risk-reward: Potential upside of 20–50% with limited downside.

- True protection: Even during market crashes, capital remains safe.

- Scalable: Works with both large-cap stocks like Apple or Microsoft and high-volatility names like Nvidia.

Key takeaways from Ravish’s approach

- Capital preservation first: Protecting 80% of his portfolio allows him to take bigger swings with the other 20%.

- Consistency matters: Generating 20–50% annual returns without extreme volatility creates peace of mind.

- Stress-free trading: These are “set and forget” trades that don’t require monitoring charts all day.

Who should use these strategies?

Ravish expplains that his low-risk options strategies are best suited for:

- Intermediate traders who want consistent income without the stress of day trading.

- Investors looking for safer alternatives to simply buying and holding the S&P 500.

- Traders who want to protect capital while still achieving market-beating returns.

They are not aimed at those looking to turn $1,000 into $10,000 overnight, but for those seeking sustainable growth, they can be a game changer.

More videos to watch

Did you like this video? Here are three other interviews you may enjoy:

Ravish is a smart guy. But he also never reveals the full story or the critical specifics. Which is fine, but he’s not upfront about it and will admit it only when his numbers are challenged as you did at the end of the video. I was in his short-lived discord group, where he did the same thing. He made a lot of claims of how much he was making on his double calendars, which for most of us were losers. When people asked for specifics of when and how he entered the trades he went radio-silent. Frustrating to say the least. Better to not say anything at all and protect your strategy than to give out partial and sometimes-misleading information. This is my main criticism. I guess he’s setting himself up to make money on the software offering he’s developing. Which is also fine. But, given his overly-slick and misleading messaging, I doubt I’d trust him or his software enough to pay money for it. People should take his information for what it is and do a thorough, independent assessment of it and find variations that work better before they deploy their money.

Hi Tap,

very usefull comment, at least for me. Can I just ask you if your comments is just related to the double calendars strategy or also to the COVERED CALL/ COLLAR strategies he most recently presented on this pages?

Danny

In my opinion, he hasn’t made any real trades, nor has he earned what he claims. He’s trying to gain exposure to sell a membership he’s offering on his YouTube channel (https://optionskit.com/strategy).

I don’t know if he’s consciously lying, which would make him a fraud, or if he’s just a poor guy seeking recognition.

Either way, he could be dangerous.

I’ve run serious backtests on Leaps strategies on his YouTube channel, and it’s impossible for him to achieve the results he shows there.

Carefully analyze the strategies he claims to use successfully.

John, you know I love your YouTube channel and your website, but I insist you should do a more in-depth check on your guests. Requiring a track record with a reputable broker might be a good idea.

Best regards.

Echo the same sentiment as Enrique. Love John’s channel and the different perspectives, but Ravish is a scam. Double calendars with SPX is reasonable with a 5 percent spread ( 4 legs ) for opening one position. Add the closing side its 10 percent. For Individual stocks, even the most liquid ones, the loss is 20 percent just to get in and out.

I got here from watching the video.

Today, Ravish has just released early access for OptionsKit.co

Would like to seek you commentators’ views on this new tool.

1. I found a similar past site https://optionsincome.co/

2. Compare with current one https://optionskit.com/

I watched Ravish’s videos and feel impressed by the high win rate strategies. Now there’s mentorship and also the Active/Income trader plans. Should I go for it?

Interesting find. OptionsIncome.co is owned by PushRoll LLC which is registered to Ravish. It looked like this in February before it was password-locked:

https://web.archive.org/web/20250215192318/https://optionsincome.co/

Kind of odd he felt the need to lock it and create a whole promotional cycle for his new service. Is this something people do when their integrity cracks and need to rebrand?

I was very pumped to join OptionsKit but now not so sure…

https://optionskit.com/

https://optionskit.com/coaching/

🔥 COACHING ENROLLMENT IS NOW OPEN 🔥

The 12-Week Live Coaching Program starts October 19th.

Details & Enrollment at https://optionskit.com/coaching/

Exclusive Offer for Existing Members

Get $297 Discount towards the coaching program with this coupon code at the checkout:

KIT297

What it means:

The 3 or 12 months period for the coaching will officially start on October 19

Your first month’s payment for the existing membership is credited as a discount towards the coaching program

Enjoy complimentary access to Discord till October 19

What You Get:

✅ 8 Live Training + 4 Q&A Sessions

✅ Complete 5-Part Trading System

✅ Lifetime Recording Access

✅ Exclusive Coaching Discord

✅ Bonus: Complimentary Discord access until Oct 19

⚠️ This is the ONLY live cohort. After this, it’s pre-recorded only.

Enroll now 👇

https://optionskit.com/coaching/

— Ravish

Should I join? Sorry I didnt know u replied.

[…] Ravish Ahuja: Two low-risk options trading strategies you need to know […]