Murray Lindhout, a former high school math teacher and experienced trader, has been actively trading options for over four years. He specializes in the 112 options trading strategy, a popular approach among retail traders looking for consistent income with minimal daily management.

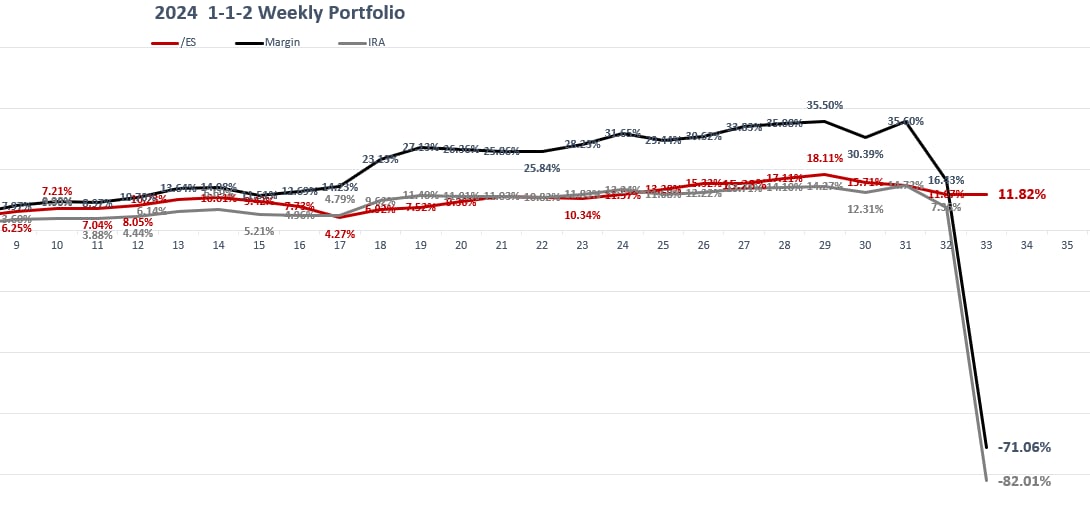

It has been a wild ride. He grew his account from $50,000 to $500,000 with the 112 options trading strategy. Then lost all his profit over a couple of days during the turbulent markets last year. Now he is back on the horse and again seeing nice profits. But after the shocking losses last year, he has made several changes to how he trades the 112 strategy.

Learn how Murray trades the 112 options trading strategy

The video was produced with Streamyard – an easy-to-use and amazing tool for live streaming and recording.

What is the 112 options trading strategy?

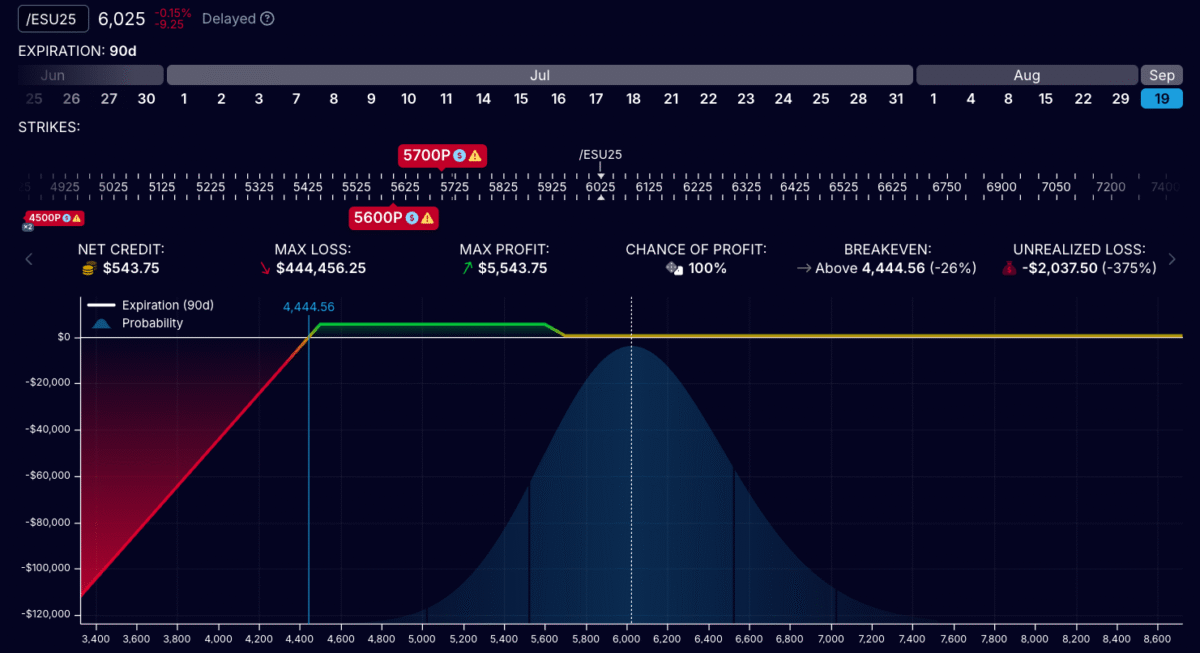

The 112 options strategy involves three key components:

- Buying one put debit spread (typically around the 25 delta).

- Selling two further out-of-the-money puts, financing the debit spread.

- The trade is set up to receive an initial credit, usually around $10 per position.

This setup aims to generate profits in various market conditions, particularly when the market is stagnant, slightly bullish, or slightly bearish. However, traders must understand the inherent risks, especially in volatile markets.

How Murray uses the 112 strategy

Murray initially adopted this strategy due to its low management requirements, allowing him to trade profitably while maintaining an active lifestyle. His typical setup involves:

- Trading on the ES futures market (S&P 500), leveraging high liquidity and favorable tax treatment.

- Setting up trades between 45 to 135 days to expiration, adjusting the spread width based on the time horizon.

- Regularly entering new positions to maintain consistent exposure.

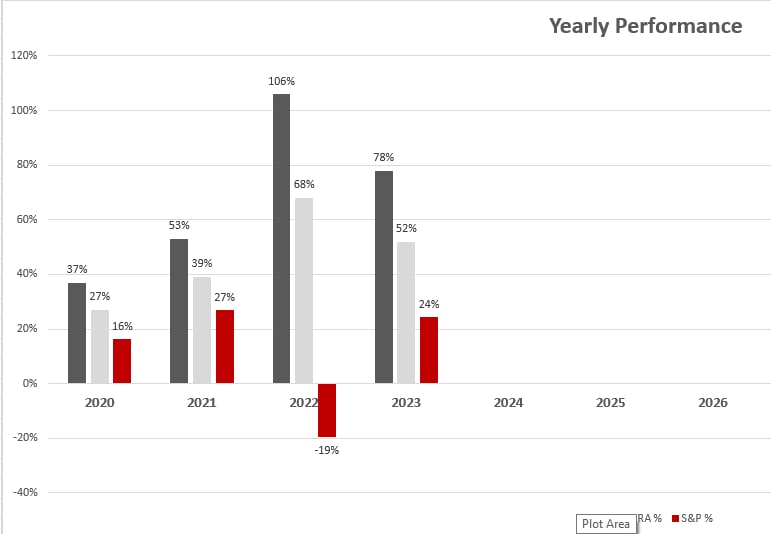

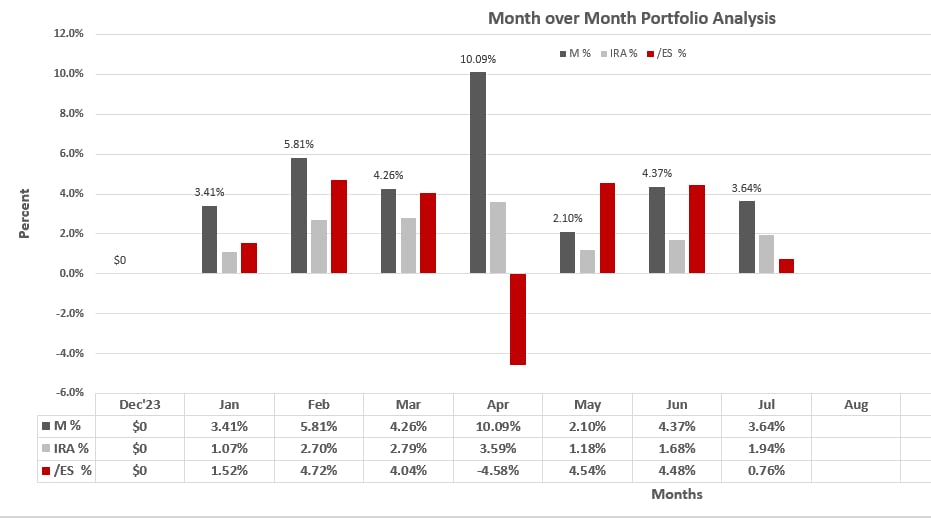

Murray’s 112 trading results over different periods

Murray’s use of the 112 strategy initially led to impressive results, turning a $50,000 account into around $500,000 over a period of four years. However, a massive volatility spike in August of last year caused him to lose nearly all these profits within days. By adjusting his approach and diversifying, Murray is back on track with positive results, achieving about 21% returns year-to-date.

- OTHER STRATEGY VIDEOS YOU MAY LIKE:

- Time Flies Spread – with Simon Black

- Double Calendar Spread – with Ravish Ahuja

- 0DTE Iron Flies – with Dale Perryman

Profit potential and key risks

According to Murray, the 112 strategy usually generates a moderate return of about 2-5% per trade if the market remains flat or moves slightly in any direction. Interestingly, a falling market can significantly boost returns due to gains from the put debit spread.

However, the major risk arises during sharp volatility spikes. In August last year, Murray faced a massive volatility spike that erased four years of profits overnight.

Lessons learned from a huge loss

In August 2024, Murray experienced a huge loss, wiping out four years of profits in just a few days. He tells the full story about this loss in the video. The experience taught him critical lessons:

- Avoid overexposure: He now maintains buying power usage at about 50%.

- Diversification: Murray now trades multiple uncorrelated assets such as gold, oil, and bonds alongside ES futures to manage risk.

- Adjustments to the strategy: He initially enters positions as 111 setups, converting them to 112 trades only when conditions are favorable.

Adjusting the 112 strategy for greater safety

Murray has refined his trading approach significantly since his big loss:

- Starting positions as 111 setups to minimize initial volatility exposure.

- Adjusting put debit spreads as trades age, narrowing the spreads and increasing the overall credit received.

- Regularly reviewing his positions to maintain optimal risk exposure and profit potential.

These strategic adjustments have allowed Murray to regain profitability, achieving around 21% returns year-to-date.

Pros and cons of the 112 options trading strategy

Murray clearly outlines the benefits and risks:

Pros:

- Minimal daily management

- Fits well with an active lifestyle

- Consistent income potential in various market conditions

Cons:

- High exposure to sudden spikes in implied volatility

- Risk of substantial short-term losses if not carefully managed

Final advice for traders considering the 112 strategy

Murray emphasizes two crucial pieces of advice for anyone interested in the 112 strategy:

- Always diversify trades across uncorrelated asset classes to manage systemic risk.

- Keep position sizes and overall buying power under control.

For further learning, Murray recommends checking out Tom King’s detailed YouTube videos about the 112 options strategy, as hands-on experience combined with learning from active traders remains the best education.

[…] Market swings are a given in options trading. We learned that trying to predict every move is a losing game. Instead, we focused on managing risk when the market got choppy. For example, when a stock we sold puts on suddenly dropped, we didn’t panic. We rolled the option to a later expiration date and a lower strike price, which is a common tactic to avoid assignment and give the trade more time to recover. This approach helped us avoid significant losses and even turn some of those trades around. It’s about being flexible, much like the strategy Murray Lindhoet used to grow his capital significantly Murray Lindhoet’s 112 options trading strategy. […]

[…] 112 options trading strategy: Profit potential and risks […]

[…] With Murray Lindhoet: 112 options trading strategy – profit potential and risks […]

Hi John,

Thank you conducting the many insightful interviews which I am finding very informative and helpful. This one specifically helped me immensely with my understanding of ratio spreads. I was burnt by having too many 112’s on at the same time when market suddenly dropped back in April this year. I did not know the best way to manage and ended up with losses through closing short puts in sheer panic. I had been like once bitten twice shy since. I am dipping my toes in 111s again after watching Murray explain his approach to this strategy.

The best thing I took away from the interview was adjusting the 112 for greater safety. Now I am seeing the strategy from a different perspective. I am following Murray’s approach of starting with longer term 150-wide 111 trade and adjusting the debit spread width along the way collecting additional premium. It now makes me feel like more in control as I am also spreading out the trades to just one in each month. This way I shall have a maximum of only 5-6 trades on with expiration dates spanning over 4-5 months or so.

Murray mentioned he would add another short put if the volatility spiked. I do not understand what exactly it means. When would he do that in regard to the lifespan of the trade? Would he consider a specific minimum percentage increase to qualify as a spike ? Is it IVR of the instrument (/ES) or the VIX? I would appreciate it very much if you or Murray himself would expand on this part of his strategy.

Thanks,

Dwipen