Ravish Ahuja from New Jersey, USA has had great success with his double calendar strategy during the last years. He says he can make 100% annual returns on the capital allocated to his double calendars.

But how does he trade double calendars? I met up with Ravish to learn more.

Watch Ravish explain how he trades double calendar spread

The video was produced with Streamyard – an easy-to-use and amazing tool for live streaming and recording.

Ravish Ahuja

Ravish Ahuja is a former FinTech product manager who transitioned to full-time trading after his options income exceeded his salary. He has developed a consistent and repeatable approach to options trading, with 80% of his money in long-term low-risk strategies, and the remaining capital in more active strategies, such as double calendars. Over three years, he has grown his trading account from $400K to over $2 million. The main motivation for his 80-20 approach is to preserve his capital.

While his double calendar strategy is returning 100% on the capital allocated for it, he does not want to increase the allocation because of the risk that a massive market drop, like in the financial crisis of 2008, would wipe out his capital.

- You may also like our video about Time Flies Spread, a similar strategy.

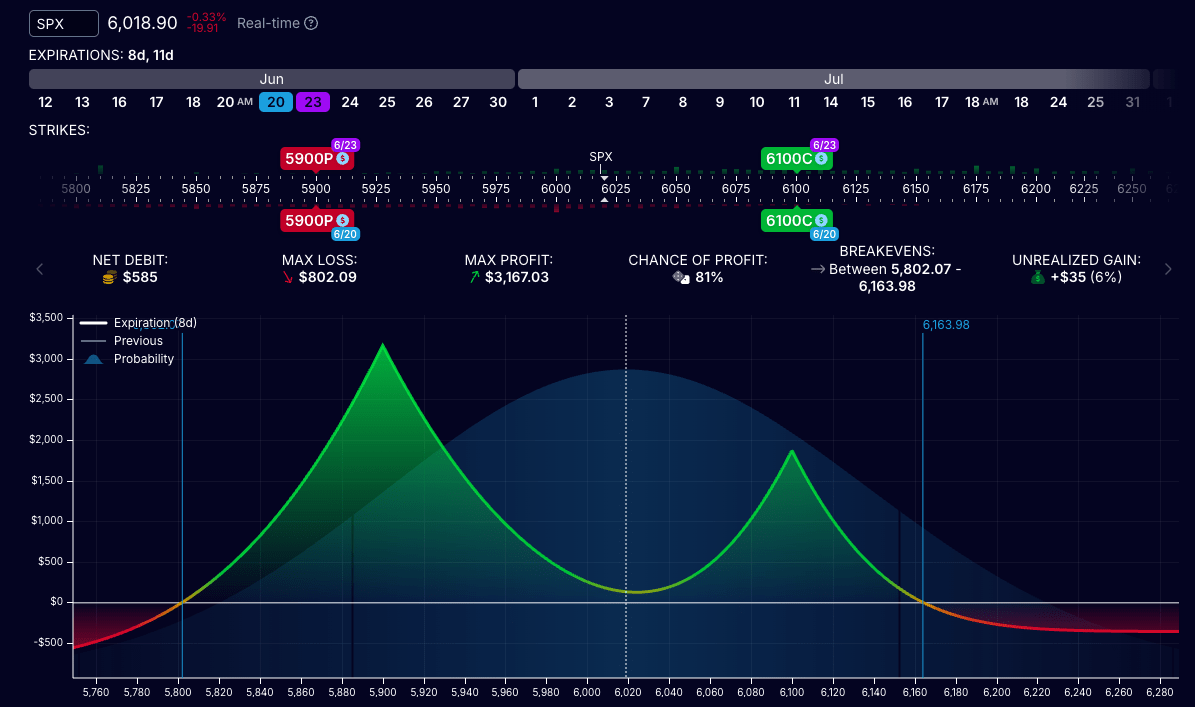

This is a double calendar

A double calendar spread is a market-neutral options strategy that combines a call calendar and a put calendar at different strike prices. The goal is to profit from time decay (theta) and changes in volatility (vega) within a defined price range. This strategy creates a wider breakeven range than traditional spreads like iron condors, offering greater flexibility.

A calendar involves selling and buying options at the same strike but with different expirations.

How Ravish trades double calendar

Underlyings: Ravish suggests to use broad indexes like SPX, QQQ or SPY as underlyings, but says that the strategy may also work on large-cap stocks.

Time horizon: Ravish prefers that the shorts be 10 – 15 days out. Typically he will enter a trade on a Tuesday or Wednesday, with the shorts expiring on Friday the next week, and the longs on the Monday thereafter.

Strike selection: Although not a strict rule, Ravish starts with strikes that are at the expected move for the options and then adjusts from there.

Profit-taking and exit rules: Ravish begins taking profits once the trade reaches a 15-20% return on risk. He never holds a trade through expiration and exits two to three days before the short leg expires to avoid the sag in the middle of the P&L curve. If the trade shows a loss, he will stay in it until the price touches one of his short strikes and then close.

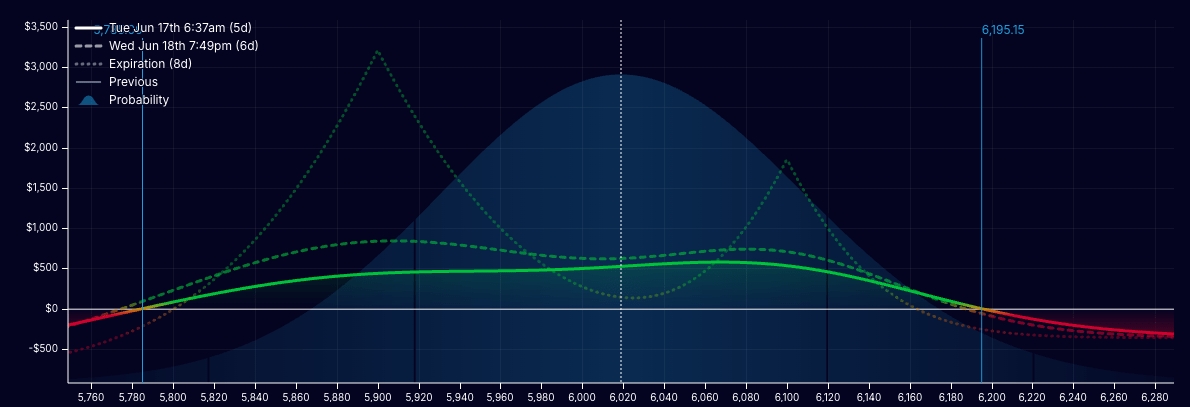

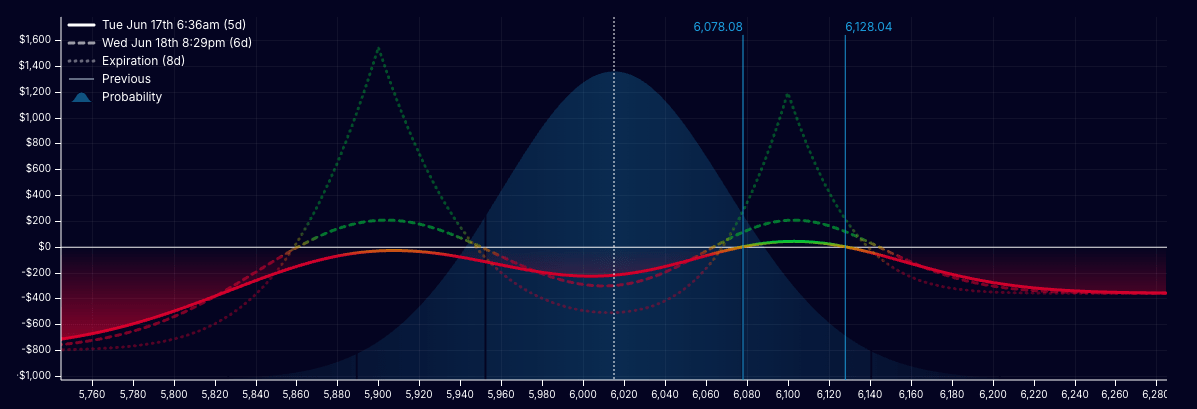

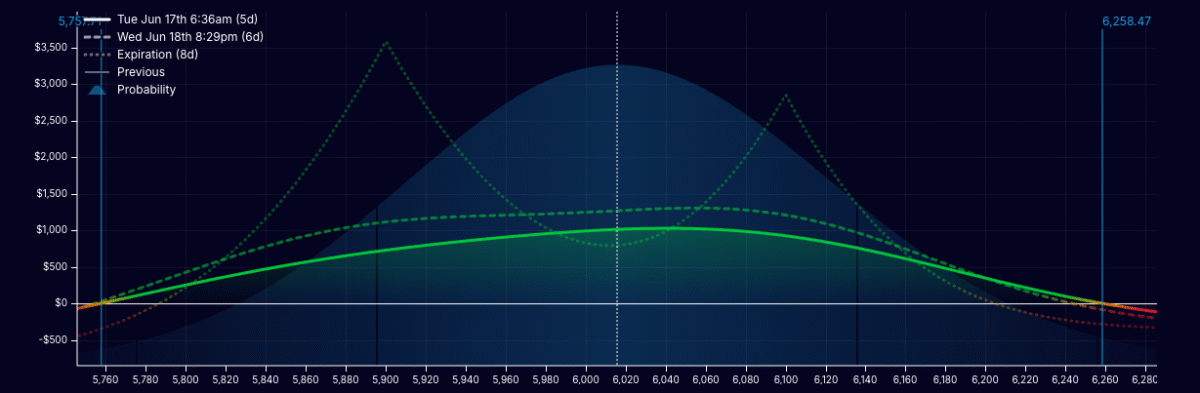

Managing vega risk: A big risk with the double calendar strategy is a big drop in Implied Volatility – or Vega or VIX. That will quickly narrow the profit zone significantly – see the illustrations below.

Ravish avoids entering trades when VIX is high and favors setups when VIX is low or steady. He also has a workaround for trading in high-VIX environments by adjusting expiration dates to make the trade less sensitive to falling volatility. Watch the video for the specifics.

Here you can see how a sudden drop og jump in the Implied Volatility affects the trade:

Watch the video for more details about his double calendar mechanics.

Risk profile of double calendar

Ravish rates the double calendar strategy as a 3 on a risk scale from 1 (very low risk) to 10 (very high risk). While the risk is defined, he remains vigilant about managing exposure during market-moving events. His win rate with this strategy exceeds 85%, and the returns on capital can be 20-30% per month.

Where to learn more

Ravish is now launching his own YouTube channel called “Options with Ravish,” where he will share more strategies and detailed breakdowns. He also recommends checking out Tastytrade as a valuable resource for learning the principles behind options trading.

Thanks for this video. What is considered high VIX environment and low VIX to know when to do the tweak?

[…] Double Calendar Spread – with Ravish Ahuja […]

Hello Ravish,

This is a beautiful strategy and you have done a good job explaining the dynamics as well as the pros and cons. I wanted to know if you have used this strategy for 0- and 1-DTE calendars. Backtest simulations using OptionOmega look promising.

Aseem Chandawarkar

Marlboro, NJ

[…] Ahuja has earlier shared how he trades his double calendar strategy. But at the same time, he emphasized that most of his trading capital, 80%, is allocated to […]

[…] Ravish Ahuja: Double Calendar Spread: The low-risk trade behind an 85% win rate […]