AI is all over us. Probably, there are hundreds of ways it can be used in options trading.

Today, we will let ONE experienced trader, Hin Man from California, show us FIVE ways that HE is using AI to improve his options trading. Hin Man posts frequently about this in the Facebook group TastyTrade Options.

Five ways this trader uses AI

The video was produced with Streamyard – an easy-to-use and amazing tool for live streaming and recording.

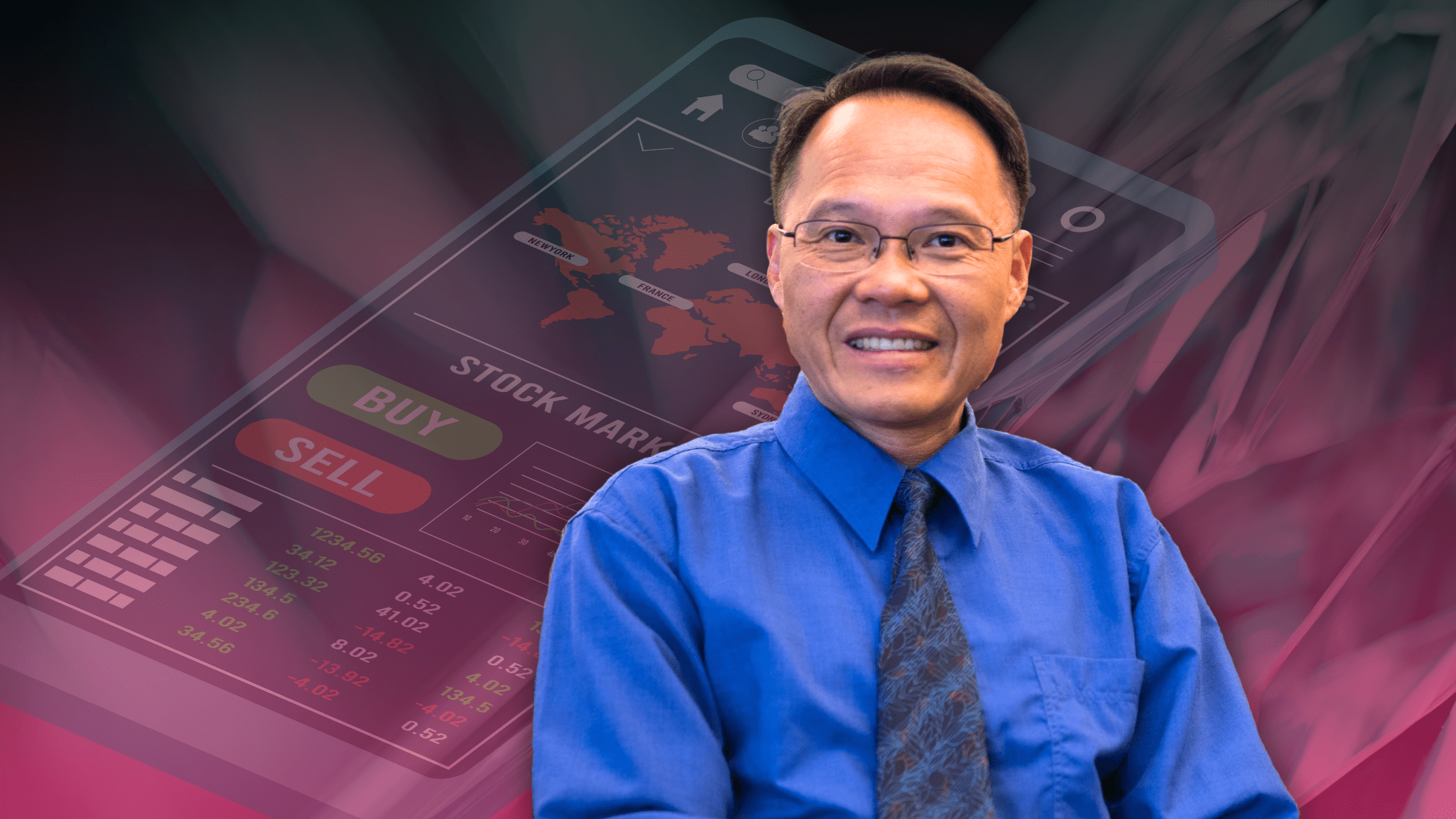

Hin Man

Hin Man is a seasoned options trader from California with a strong background in computer science and data analytics. He worked 16 years as a data analytics engineer in Yahoo before he retired in 2021.

Having started options trading in 2016, he now combines years of market experience with the latest in artificial intelligence to improve his results and decision-making.

- You may also like the following videos:

- 112 options trading strategy: Profit potential and risks

- VIX spikes: Here is an easy options trading strategy to profit

- How to set up risk-free options trades

How trading with AI transforms options strategies: 5 steps from the interview

The purpose of this video interview is NOT to give a full overview of trading with AI. Rather, we want to inspire by showing how one trader uses the technology.

In the video interview, he shows five ways he uses Microsoft CoPilot to enhance his options trading.

AI use 1: Research fundamentals and do technical analysis

Hin Man uses AI as his first stop when looking at new stocks. He asks AI tools like Copilot to give him a complete overview of a company’s background, news, and performance, including competitors and analyst sentiment.

Then, he goes further by having the AI run technical analysis, asking for indicators like like CCI, MACD, and EMA to get an instant read on current stock trends—all in one place.

AI use 2: Screening the stocks based on your criteria

Rather than sorting through charts and screeners by hand, Hin Man asks Copilot to compare multiple stocks and rank them based on his preferred indicators—like CCI, MACD, and EMA across various timeframes. This way, the AI provides a clear ranking of which stocks show the strongest momentum or fit his trading criteria, so he can focus on the top candidates.

AI use 3: Design trading strategies

After identifying promising stocks, Hin Man uses AI to help design his actual trading strategies. He tells the AI what type of trade he wants – such as a Jade Lizard or a put credit spread – and asks for specifics like strike selection, premium, probability of profit (POP), risk/reward, and max profit. The AI even suggests safer or more aggressive alternatives, allowing him to compare options and tailor each trade to his risk profile.

AI use 4: Find specific trades based on your criteria

When Hin Man is ready to trade, he asks Copilot to recommend specific trades that match his chosen strategy and risk level. He often requests two alternatives—a trade with a higher reward and a safer one—so he can compare the POP, risk/reward ratio, and premiums before making a final decision. This approach helps him quickly zero in on the best opportunities without second-guessing.

AI use 5: Trade journaling

Hin Man closes the loop by using AI for trade journaling. He feeds his trade data into the AI, which then summarizes win rates, expectancy, emotional notes, and more. This gives him quick feedback on his performance, highlights what’s working, and helps him improve his trading process over time.

Key takeaways for trading with AI

- Specificity is key: The more detailed your AI queries, the better the answers.

- Trust, but verify: Use AI to save time and generate ideas, but always double-check critical data.

- AI as an assistant: Think of AI as a tireless research partner, not a replacement for your judgment.

- Continuous learning: The more you interact with AI tools, the more you’ll benefit and adapt.

How to start trading with AI

Hin Man encourages traders to experiment with AI tools—don’t just read or watch, but ask real questions and use AI in your trading workflow.

For those looking to develop deeper skills, platforms like Coursera and Google offer accessible courses in AI, data analysis, and financial modeling.

Book recommended in this video

Hin has this book to recommend for options traders who like to learn more:

- Mark Douglas: Trading in the Zone