Here is a 0DTE options strategy with a built-in protection if the market suddenly moves against you. Physician Azhar Pasha takes us through his latest 0DTE options strategy: Adaptive Butterfly.

Learn about the 0DTE Adaptive Butterfly strategy in this video

Azhar Pasha

Azhar Pasha is a practicing anesthesiologist in Florida, USA, who also trades options. Earlier this year he was a Rising Star on Tastylive, where he told about how success in options trading has taken him to a trading account of $24 million.

Today, we dig into his latest and so far very successful strategy, not covered in the Tastylive interview.

The 0DTE Adaptive Butterfly strategy

Like many options sellers, Pasha started with SPX credit spreads, but he realized that one bad day in the market could wipe out weeks of profit. To fix that, he designed a structure that adds built-in protection without giving up too much premium.

“Having a debit spread facing the market gives me protection,” Pasha says. “As the credit spread loses value, the debit spread gains,vacting like a shield.”

This approach allows him to stay in the trade, adapt intraday, and still collect premium even when the market moves sharply.

- More about 0DTE options trading on Theta Profits

- Tammy Chambless: The Multiple Entries Iron Condor (MEIC)

- Dale Perryman: 0DTE Iron Fly on SPX

- Mark Anderson: Five essential 0DTE tips from a hedge fund pro

- All our videos about 0DTE options trading

How the 0DTE Adaptive Butterfly structure works

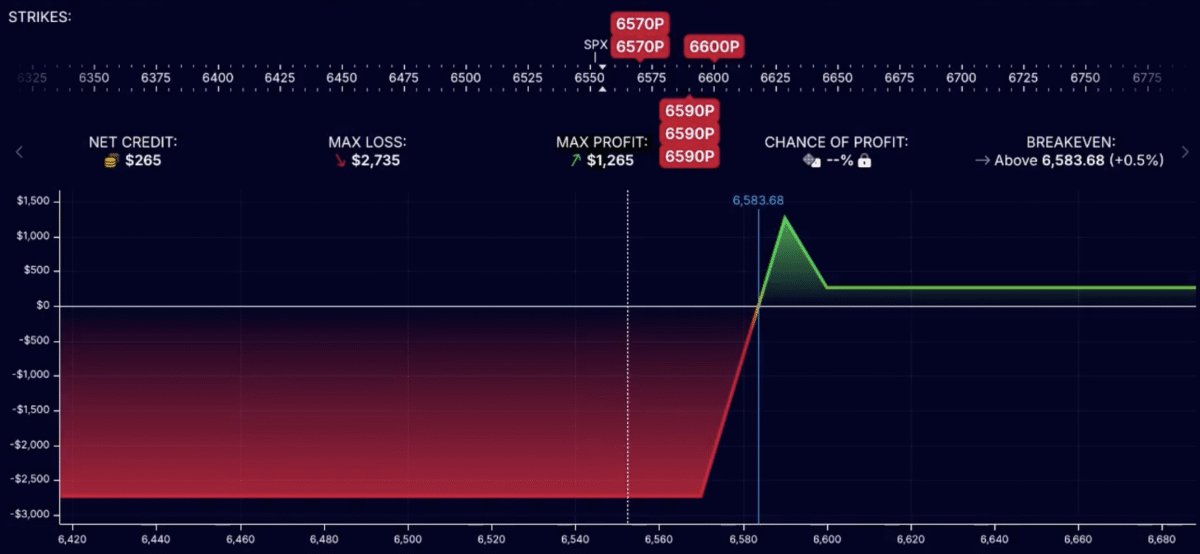

Pasha’s 0DTE Adaptive Butterfly strategy combines income from credit spreads with defense from a debit spread.

He sets up a broken-wing butterfly on the put or call side of SPX, depending on the trend.

The trade opens for a net credit, typically around $0.40 or more.

One debit spread faces the market, while two credit spreads sit further out of the money. The shorts of all three spreads are identical.

If the price moves against him, the debit spread gains value and offsets parts of the loss on the credit side.

When momentum flips, he can “adapt” the position by switching from puts to calls or vice versa — keeping him aligned with intraday direction.

The role of Gamma exposure

A key part of his process is tracking live gamma exposure (GEX) data to see how market makers are positioned. These levels often act as real-time support and resistance zones. Azhar uses the tool Optionsdepth.com for this.

Market maker long gamma often acts as resistance when prices rise and support when they fall. Customer long gamma can attract price movement, functioning like a magnet.

By aligning his strikes with these levels, Pasha hopes to gain an informational edge as well as time to manage adjustments before losses grow.

Entry timing and risk management

Pasha usually enters trades pre-market or right at the open to capture higher implied volatility. He keeps rules simple and consistent.

- He targets the 5–10 delta strike for the nearest long leg, depending on the Gamma exposure levels.

- He places three short strikes 10–20 points further out, and then two long legs further out .

- He uses only about 20 percent of his account capital per day.

- He goes to cash every night — no overnight risk.

If the market moves quickly, he flips direction rather than waiting for a stop-loss to hit. This flexibility is what makes the strategy “adaptive.”

When the market moves against him, Azhar will often try to flip the trade to benefit from the new direction. In the example trade, this could be to sell the two long 6570 puts and buy two long 6720 calls. He would then sell the 6600/6590 to finance this, leaving him with two short call credit spreads of 6600/6720 as his new total position.

This process is explained in detail in the video.

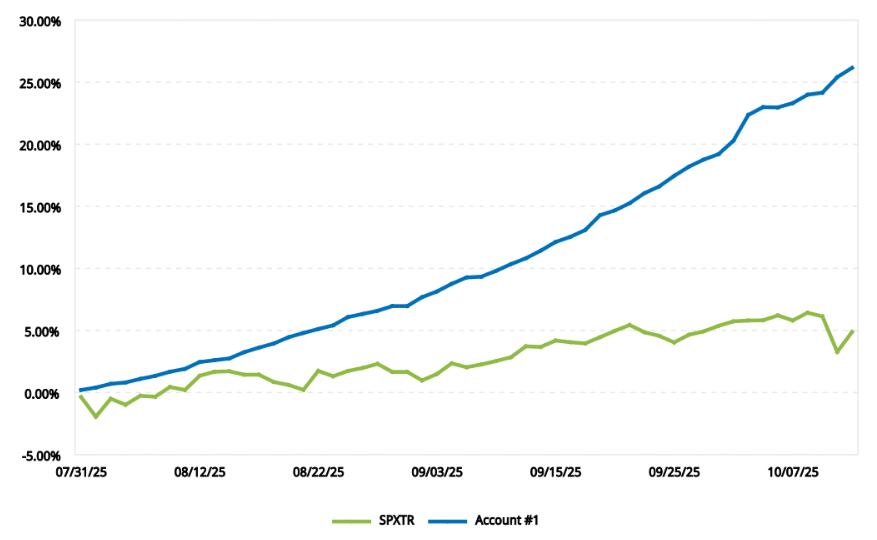

Results so far: 10% per month

After three months of trading the setup live, Pasha reports around 10 percent monthly returns, verified through IBKR’s Portfolio Analyst. He has had just one small losing day in that period.

He rates the risk level as four out of ten, compared to an eight or nine for traditional SPX credit spreads. The reason: the debit spread protection limits maximum loss to roughly half of a normal credit-spread drawdown.

Who does this strategy fit

This method is not for set-and-forget traders. It requires intraday attention and a clear trade plan. Pasha trades it only on days he is not in the clinic.

It suits traders who already understand credit spreads and butterflies, can watch the market throughout the session, and want steady income with tight risk management.

Key takeaways

- Protection matters — adding a debit spread changes the entire risk profile.

- Stay adaptive — flip direction when price and gamma data demand it.

- Trade small and go to cash — avoid overnight exposure.

- Know your levels — use gamma exposure to read support and resistance in real time.

“If you trade small, have a plan, and stay adaptive, you can win consistently,” Pasha says.

I think the link for the gamma data should be optionsdepth.com — there’s a typo.

Thank you, David! It has been corrected now 🙂

For such multi-leg low credit strategies (like $0.40) it would be good to address commission effects (and potentially slippage)