In this Theta Profits interview with Carl Allen, we explore the Rolling Put Credit Spread, a strategy that can generate steady weekly income, but also test a trader’s discipline and risk tolerance when markets turn volatile.

Watch Carl Allen explain how he trades Rolling Put Credit Spread

Carl Allen

Carl Allen is an engineer-turned-options-trader who runs the website DataDrivenOptions.com. Known for his mechanical, data-driven approach, he’s traded numerous strategies over the years — but one of his favorites is the Rolling Put Credit Spread, a method he calls both high risk and high reward.

- Other video interviews with Carl Allen:

- Carl Allen: 21DTE Put Broken Wing Butterfly

- Carl Allen: Back Ratio Call Spread

What is a Rolling Put Credit Spread?

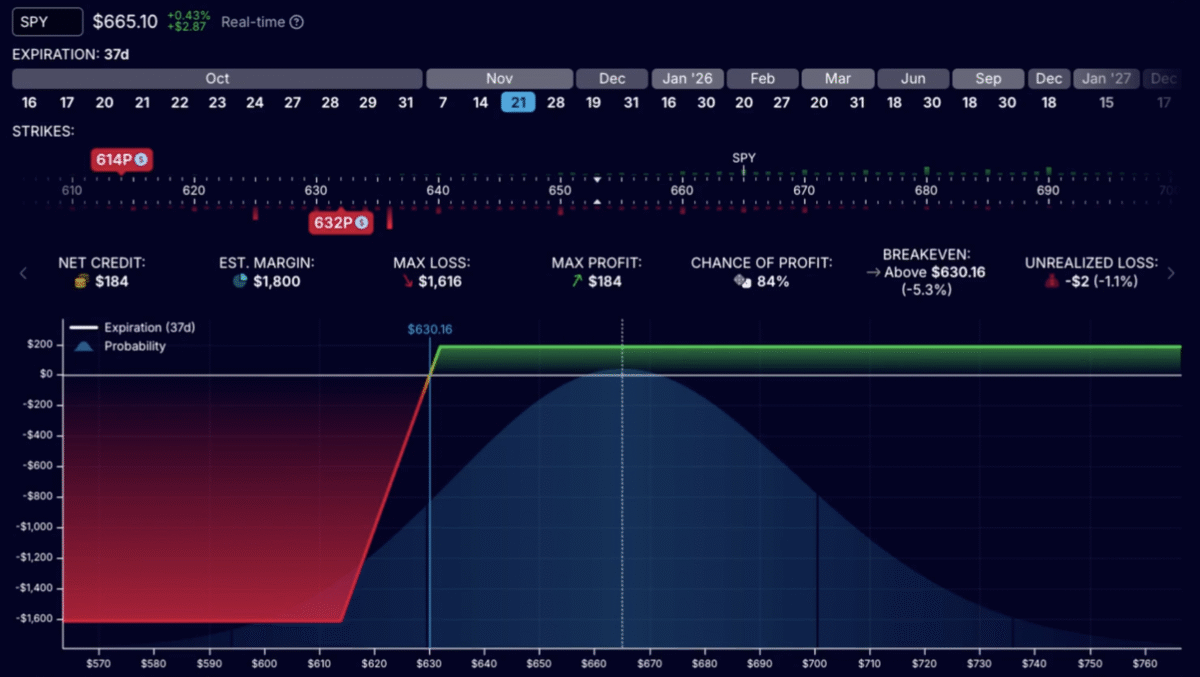

A Put Credit Spread is a bullish options strategy that profits if the market stays flat or moves higher. It involves selling one out-of-the-money put and buying another at a lower strike price to define the risk. The trade earns a credit upfront — the maximum profit — while the risk is limited to the difference between strikes minus the premium received.

Carl adds a twist: he rolls the position weekly to continuously collect credits and manage his risk exposure. Each week, he closes the existing spread and opens a new one further out in time, ideally for another credit. This process creates a systematic rhythm — one that works smoothly in calm markets but gets tested in volatile ones.

How Carl trades Rolling Put Credit Spread

Carl says he likes Rolling Put Credit Spreads because it:

- Has defined risk and high probability of profit

- Allows mechanical decision-making — no guessing or emotions

- Can generate steady theta income week after week

Carl starts with selling a 20 delta put and buying the 13 delta put with an expiration four to six weeks out (typically around 35 days). He has analyzed many combinations and concluded that the 20/13 delta setup provides the best ratio of time decay (theta) to risk.

He prefers to use index-based ETFs (SPY, IWM, or QQQ) or index options (SPX, NDX, RUT) as these tend to have less volatile swings than individual stocks.

The weekly roll

Each week, Carl reviews his open position and rolls it one week further out in time — aiming to:

- His main rule is to always roll for a credit

- Adjust strikes to maintain 20/13 deltas

- Keep expiration safely distant. By rolling every week, he resets the expiration to what he started with, for instance five weeks out.

If the market rises, rolling up often brings in a healthy additional credit. If the market drops, he rolls down, but only as far as he can while still collecting a credit. This disciplined process repeats every week, maintaining consistency and avoiding emotional decision-making.

What happens when the market falls

The “brutal” part comes when markets keep moving down. Once a spread goes in-the-money, decay starts working against the trader. The short put increases in value faster than the long put, leading to unrealized losses.

Carl explains that when that happens, he faces three options:

- Roll forward at the same strikes, paying a small debit to buy time.

- Roll down to out-of-the-money strikes, accepting a larger debit but regaining positive theta.

- Close the trade completely, realizing the loss and resetting later.

Most of the time, he chooses the first or second approach, aiming to stay in the trade long enough for the market to rebound — because history shows markets usually recover, and the big gains come right after big selloffs. Carl explains that he sets aside additional capital to be able to take on this extra risk.

The emotional challenge

Carl is very open about the emotional side of the Rolling Put Credit Spread strategy.

He admits that holding through drawdowns can be nerve-wracking:

“You can see a drawdown well over 100% of what you started with. You’ve got to have the risk tolerance to handle that.”

That honesty is rare — and one reason this interview stands out. He warns traders not to commit too much capital to this strategy and to always keep reserves ready for additional margin or adjustments.

Risk vs. reward

On a scale from 1 to 10, Carl rates the Rolling Put Credit Spread as an 8 or 9 in risk.

The potential rewards are significant; he targets 50–80% annualized returns on the portion of his portfolio he dedicates to it, but it requires both capital and conviction.

He emphasizes that this trade should never represent a large share of one’s portfolio. For him, it’s roughly 10% of his total trading capital.

Ways to reduce risk

Carl also discusses variations for traders who want to reduce risk exposure:

- Use lower deltas (e.g., 15/10) to stay further from the money.

- Trade longer durations (6–8 weeks) for more time to adjust.

- Be flexible about rolling — sometimes paying a debit is fine to reset deltas.

These adjustments lower returns but make the strategy more forgiving — ideal for those new to rolling mechanics.

Results over time

In his backtesting and live trading, Carl has seen consistent returns — as long as markets stay within typical ranges. On average, his weekly time decay produces about 1% of the spread width per week, translating into roughly 50% per year before adjustments. He will also benefit from the market going up.

But, he reminds viewers, the averages hide the pain of downtrends. Periods like the 2022 bear market can test both patience and capital, with rolling debits adding up over time. Yet, when markets recover, much of that loss can reverse quickly.

Who should trade Rolling Put Credit Spread

Carl recommends the Rolling Put Credit Spread only for traders who:

- Are comfortable with defined risk but large swings in equity

- Have a disciplined, mechanical mindset

- Can allocate only a small portion of capital to high-risk trades

- Understand that winning most weeks doesn’t mean low risk

It’s a method built for those who value data, structure, and mental resilience more than thrills.

Key takeaways

- Rolling Put Credit Spread can be a steady income generator — but they demand discipline.

- The strategy shines in calm or rising markets and challenges traders in sustained selloffs.

- Success depends on position sizing, rolling discipline, and emotional control.

- As Carl says: “It wins week after week — until it doesn’t.”