We continue our series of interviews about the options Greeks together with Mat Cashman from the Options Industry Council. Previously, we have covered Theta and Vega. Today, we delve into Delta.

Learn all about Delta in this video

The video was produced with Streamyard – an easy-to-use and amazing tool for live streaming and recording.

Mat Cashman

Mat Cashman is Principal of Investor Education at the Options Industry Council (OIC). With a background as a professional options trader since 1999, Mat has traded equity, index, and bond options in both the US and Europe. Today, he focuses on teaching traders how options work and how to use them effectively.

- Watch our two previous videos with Mat about options Greeks:

- Theta explained: What every options trader must know¨

- How Vega and implied volatility affect every options trade

What is Delta?

Delta is one of the core options Greeks. It measures how much the price of an option changes when the price of the underlying asset moves by $1.

Example: If an option has a Delta of 0.50, the option price should increase by about $0.50 if the underlying stock goes up by $1.

Put simply: Delta is your option’s speedometer. Just like a speedometer shows how fast your car is moving, Delta shows how quickly an option’s value is expected to change relative to the stock.

How to read Delta

Mat likes to talk about Delta in three categories of options:

- Deep in the money options: Delta approaches 1.00 (or 100). These options move almost in sync with the underlying stock.

- At the money options: Delta is around 0.50 (or 50). The option price moves about half as much as the stock.

- Out of the money options: Delta approaches 0.00. These options have little immediate sensitivity to stock price moves.

Delta is usually expressed as a decimal, but many traders simply think of it as a percentage.

Delta as probability

Many traders interpret Delta as the probability that an option will expire in the money. For example, a call option with a Delta of 0.76 can be seen as having a 76% chance of ending up in the money.

This intuitive view makes Delta especially useful for newer traders. Instead of thinking only in formulas, you can use Delta to frame your trades in terms of probabilities.

Why Delta is not static

A key insight Mat Cashman emphasizes: Delta changes. It is not fixed. Factors that affect Delta include:

- Gamma: The Greek that measures how Delta itself changes with price moves.

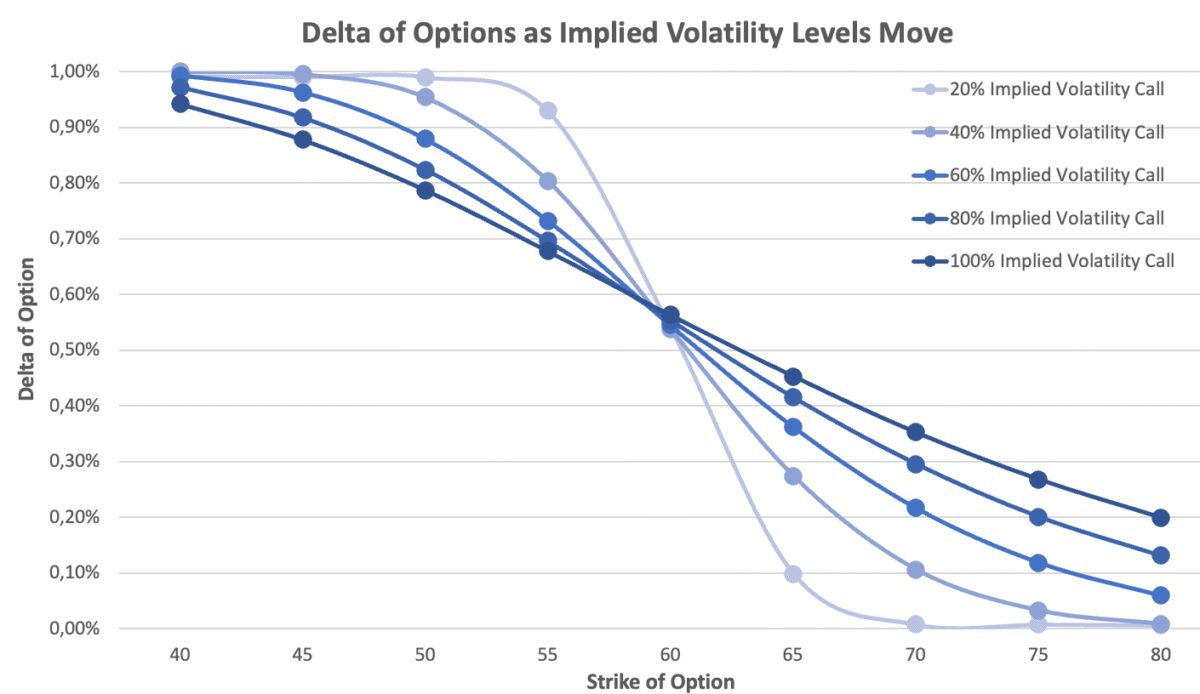

- Implied volatility: In volatile markets, Deltas tend to converge toward 0.50, making it harder to predict option price moves.

- Time: As expiration approaches, Deltas often shift, especially for options near the strike price.

This dynamic nature means traders must always track their Delta exposure, not assume it stays constant.

Example: 2008 financial crisis

During the 2008 financial crisis, markets were so volatile that daily swings of 100 points in the S&P 500 were considered normal. In that environment, implied volatility was sky-high, and Deltas across the board shifted toward 0.50. This meant options behaved differently from what traders were used to in calmer markets.

This story underlines why Delta is more than just a number — it reflects changing market conditions.

Where to learn more

Mat recommends the free educational resources provided by the Options Industry Council.