Can an options strategy really pay for designer shoes – that is $1,500 per pair – every week? In this interview, Maria and Rob Helmick, with big smiles, reveal how the Maria Shoe Trade turned into a repeatable way to generate income using the iron butterfly strategy.

And it got Maria more than 50 pairs of designer shoes and lots of exclusive purses along the way.

Watch Maria and Rob explain the Maria Shoe Trade

Maria and Rob Helmick

Maria Helmick is a full-time options trader with a colorful backstory. A former banker, business owner, and real estate investor, she eventually turned her attention to trading the markets. Together with her husband Rob, a former lawyer, bookmaker, and entrepreneur, the couple now trades options side by side every day.

The couple lives in Daytona Beach in Florida, USA.

Their most talked-about creation? The Maria Shoe Trade — a simple but disciplined approach to day trading the SPX.

The story behind the Maria Shoe Trade

The trade began when Maria and Rob lived near a Christian Louboutin store in New York. With a growing love for designer heels, often costing around $1,500 a pair, Maria set herself a goal: to make $300 a day in trading profits so that she could afford one new pair of shoes each week.

That goal inspired what became known as the Maria shoe trade. Soon after, her husband Rob shared the concept in trading communities, where it quickly gained attention for its mix of humor, relatability, and effectiveness.

The couple even made an entertaining website about the trade and Maria’s passion for shoes.

How this Iron Butterfly 0DTE strategy works

At its core, the shoe trade is a 0DTE (zero days to expiration) iron butterfly strategy, also known as an iron fly. Here are the key mechanics:

- Underlying: SPX (S&P 500 Index)

- Setup time: Around 10:30 AM EST, after the morning volatility has calmed down

- Structure: Sell an at-the-money call and put, with $20 wings on each side

- Buying power: She will typically receive around $1,200 in credit, which gives a buying power/max risk of $800 per contract

- Profit target: 25% of premium collected

- Exit rule: Close at profit target or by 2:30 PM, whichever comes first. Maria uses now stop loss.

The results of Maria Shoe Trade

On average, the trade has generated about $111 per day per contract since mid-2023. Maria typically ran three contracts to reach her $300 daily target, enough for those famous shoes.

Rob is an avid backtester and uses Option Omega for this. Every weekend he backtests hundred thousands trade to prepare for his automated tradings the next week.

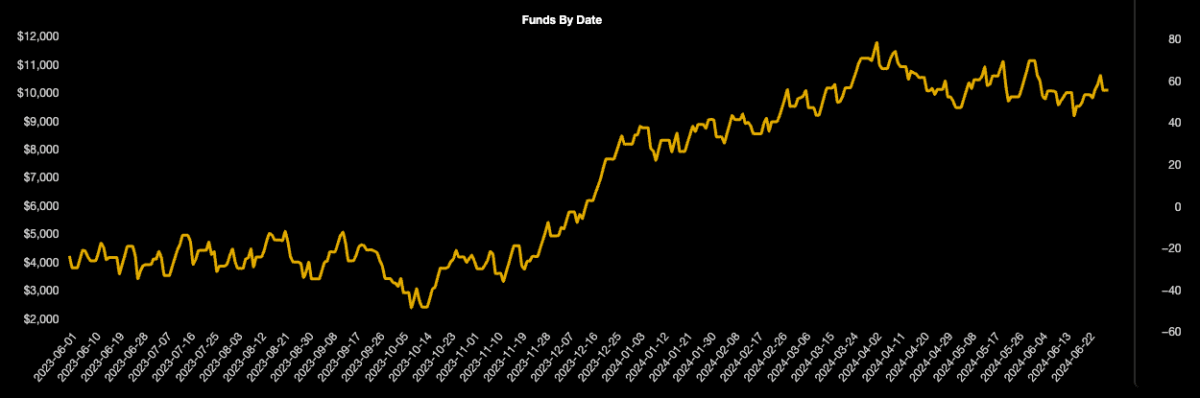

Here are his backtest results for the Maria Shoe Trade strategy.

According to Maria and Rob, their actual results are better than the backtest results. Rob attributes this to his conservative approach when backtesting.

- Option Omega is the best backtesting tool out there. Get 50% OFF your first year if you use this affiliate link.

Why it resonated with traders

The Maria shoe trade spread quickly in options communities because it checked several boxes for retail traders:

- Simple rules: Easy to understand and execute daily.

- Defined risk: The $20 wings provide clear maximum loss parameters.

- Low capital need: With under $1,000 buying power per contract, it’s accessible for smaller accounts.

- Fun backstory: Linking a disciplined trading routine to buying designer shoes made it memorable and engaging.

Beyond the Iron Butterfly

While the iron butterfly strategy made Maria’s name in trading circles, she and Rob stress that it was only the beginning. Over time, they expanded into other approaches, including:

- The wheel strategy: Buying stock and selling covered calls and puts.

- Naked puts and calls: With carefully managed size and risk.

- Automated “robot trades”: Multiple-entry iron condors based on Rob’s extensive backtesting.

Both Maria and Rob emphasize discipline, patience, and sticking to rules. Maria highlights the importance of not overtrading, while Rob stresses trading small and often — and even suggests that trading as a couple has strengthened their relationship.

- Watch some of our other interviews with retail options traders

- Bill Belt: Rolling Put Diagonal

- Steve Ganz: Flyagonal

- Ross Young: Jade Lizard

- Carl Allen: 21DTE Put Broken Wing Butterfly

Key takeaways from the interview

- Discipline is everything – Success comes from consistent routines, not chasing trades.

- Keep risk defined – The iron butterfly setup gave Maria peace of mind while trading daily.

- Start small, scale later – Even one contract can generate steady returns when repeated over time.

- Have fun with trading – For Maria, tying her trading goal to shoes made the process motivating and enjoyable.

Resources recommended by Maria and Rob

The couple credits much of their early learning to Tastytrade’s educational content, along with years of practice and experimentation. They also stress the value of using backtesting tools and, more recently, AI tools like ChatGPT to analyze stocks and strategies quickly.

Summing up

The Maria shoe trade may have started as a playful way to afford designer heels, but it also demonstrates how a clear, rules-based strategy can deliver consistent results. For many retail traders, it’s a reminder that options trading can be both profitable and — with the right motivation — a lot of fun.

If I run the backtest starting 2023 Jan 1st – today, enabling “Cap non-opening profits” and “Require two prices at profit target” plus the fees I have to pay starting with $10k the P&L amounts to ($9,581).