MEIC – Multiple Entry Iron Condors – has become a popular 0DTE options trading strategy, not the least because of its small drawdowns. In this excerpt from our recent Theta LIVE session about “3 ways to trade 0DTE”, Tammy Chambless gives a very good summary of MEIC and how she trades it.

Watch Tammy Chambless explain the MEIC 0DTE options strategy

Tammy Chambless

Tammy Chambless – the “Queen of 0DTE” – has been trading options since 2006 and has focused exclusively on 0DTE options since 2019. With years of experience developing and testing strategies, she is known for her structured and disciplined approach. Her signature method is the MEIC strategy — Multiple Entry Iron Condors — which aims to deliver consistency and reduce drawdowns in one of the most challenging forms of trading.

- Other videos with Tammy Chambless

- Backtesting options strategies made easy

- 0DTE options trading for beginners

What are 0DTE options?

0DTE stands for “zero days to expiration.” These are options that expire the same day they are traded. Traders are attracted to 0DTE options because:

- They offer frequent trading opportunities (daily on SPX)

- There is no overnight risk

- Small intraday moves can generate significant returns

But they also require precision and discipline. Without clear rules, traders risk large losses in a very short time.

Watch the full recording from Theta LIVE here

This video is an edited excerpt from our Theta LIVE session about “3 ways to trade 0DTE” on September 10, 2025. Watch the full recording of the live session by clicking on the banner below.

Tammy’s MEIC strategy explained

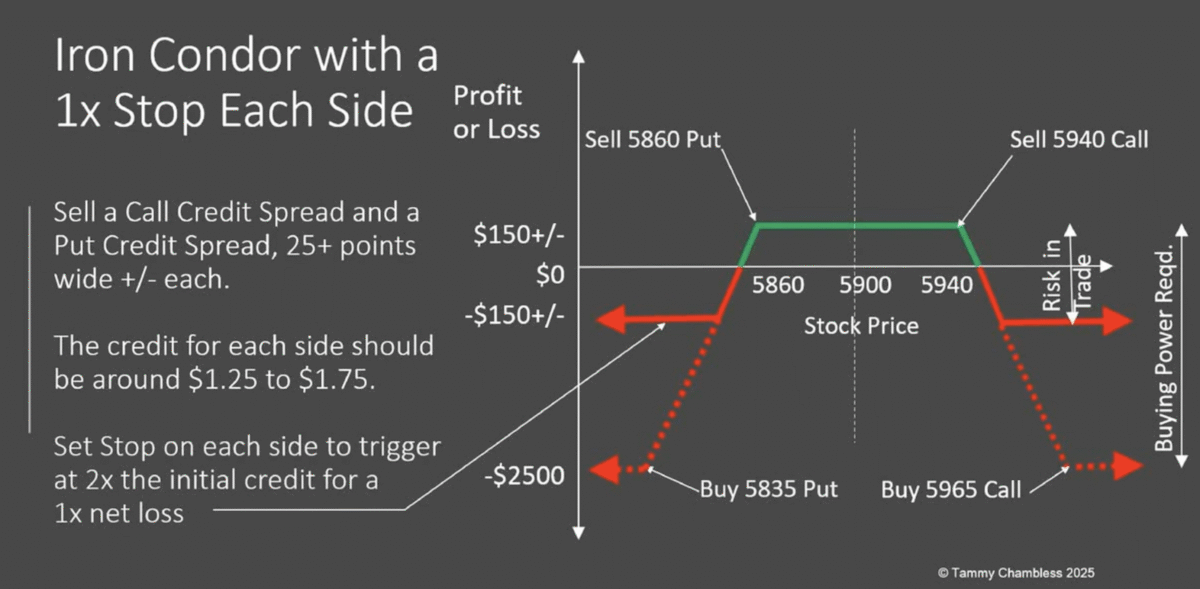

At the heart of Tammy’s trading is the MEIC — Multiple Entry Iron Condors. Unlike a single-entry Iron Condor, MEIC involves entering multiple condor positions throughout the trading day. This smooths results, reduces volatility, and avoids the danger of relying on just one entry.

The MEIC rules

- Tammy enters six trades per day, typically spaced 30–60 minutes apart and opened at pre-defined times.

- Each trade is an Iron Condor, aiming for a credit of $1-$1.75 on each side

- Spread widths are 50-60 on average, with a max of 100. Other traders may choose smaller widths, down to 25.

- Stop losses are set on each side separately, equal to the credit received for the full Iron Condor. Example: If she collected $1.5 on each side, a total of $3, the stop loss on each side will be set at $3.

- Tammy enters and manages each side of the Iron Condors separately. The trades are left on until they either hit the stop or expire worthless.

The goals of MEIC

The goal of MEIC is not to hit home runs. Instead, it aims to:

- Deliver consistent results

- Minimize drawdowns

- Keep losses manageable by using clear stops

- Allow flexibility through multiple entries rather than one all-in trade

The MEIC+ variation (Tammy’s twist)

Tammy’s MEIC+ is a small but important modification to standard MEIC designed to turn many break‑even days into small winners. Roughly 30% of her trading days tend to finish flat; MEIC+ adjusts the stop so those days often net a slight gain instead of zero.

Core change: set the stop $0.10 below a 1× net loss on each side. Example: if the credit is $1.00, a 1× net stop would be $2.00; MEIC+ uses $1.90. If one side is stopped and the other expires worthless, the loss is slightly smaller than the win, nudging the day positive. This is particularly useful on trending days when the market keeps moving in one direction.

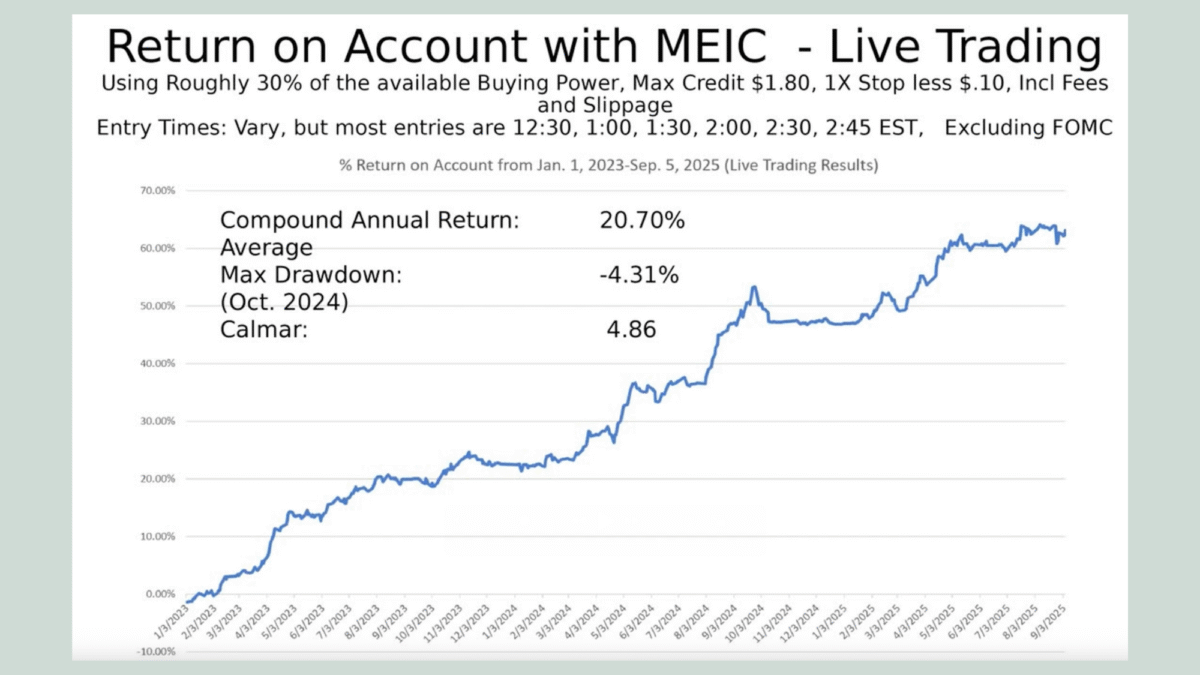

Results from trading MEIC

Tammy has had a compound annual return of 20.7% since January 2023, with a max drawdown of only 4.31%.

Here are the results as presented in the video:

Automation and tools

To handle multiple trades per day, Tammy uses trading automation software such as Trade Automation Toolbox and Trade Steward. These tools allow her to:

- Automate entries and stops

- Manage trades efficiently throughout the day

- Maintain discipline without relying on emotions

Automation supports her systematic approach and ensures consistency across all MEIC trades.

- Videos about similar 0DTE strategies

- David Berndsen: A consistently profitable 0DTE Iron Condor strategy

- Nick Magno: How Nick doubled his trading account with 0DTE Iron Condors

Key takeaways

- MEIC (Multiple Entry Iron Condors) spreads risk by using several entries instead of one.

- Discipline is non-negotiable — always use stop losses and define risk.

- Backtest before trading live to ensure an edge and avoid surprises.

- Account size matters — MEIC requires sufficient capital to manage trades properly.

- Automation helps — tools make execution consistent and reliable.

Where to learn more

Tammy shares her trading results daily in the Facebook group Quantum Options.

She has also published several in-depth videos about how she trades MEIC on her own YouTube channel.