It is time to dig into another option Greek; this week it is Vega, the sensitivity to implied volatility. Our guest is Mat Cashman from the Options Industry Council. Earlier, he explained another option Greek to us, Theta.

Learn about Vega and implied volatility in this video

The video was produced with Streamyard – an easy-to-use and amazing tool for live streaming and recording.

Mat Cashman

Matt Cashman is Principal of Investor Education at the Options Industry Council (OIC). A veteran options trader, former market maker, and educator with 25+ years of experience, he’s taught thousands of investors how to understand complex risk and use options the way professionals do.

Why Vega and implied volatility matter

Whether you realize it or not, Vega and implied volatility (IV) are impacting every single one of your trades.

- Vega measures how much an option’s price changes when implied volatility changes.

- Implied volatility reflects how much the market expects the underlying stock to move in the future.

Together, these two elements determine the real risk and potential reward of your options positions — and ignoring them is a mistake too many retail traders make.

What is Vega in options trading?

Vega is one of the key “Greeks” in options trading. It tells you how much the price of an option will change with a 1% change in the implied volatility of the underlying.

For example:

- A Vega of 0.12 means that for every 1% move in implied volatility, the option’s price is expected to change by $0.12.

💡 Matt’s warning: “There’s Vega in every option, regardless of its duration.”

That means whether you’re trading weeklies, monthlies, or LEAPS, you have Vega exposure — and it could be quietly driving your profits and losses.

- You may also like these videos:

- Theta explained: What every options trader must know

- 0DTE options trading for beginners

- Position sizing: The overlooked key to options trading success

Understanding implied volatility

Implied volatility is the market’s forecast for how much a stock might move over the life of the option.

- High implied volatility = higher option prices

- Low implied volatility = cheaper options

Implied volatility is dynamic, driven by supply, demand, and market events like earnings or economic data. And because option prices and IV are tightly linked, changes in volatility will directly impact your option value.

“Implied volatility is the single largest component of an option’s price.” – Matt Cashman

Duration and Vega: Why time changes everything

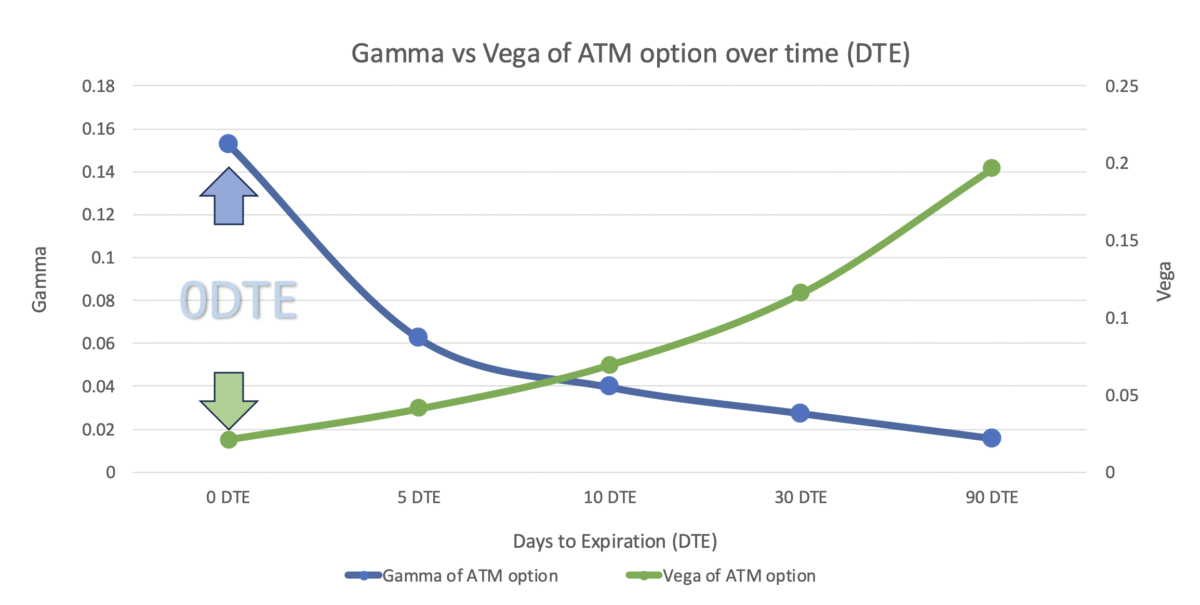

Vega has a direct relationship to time:

- Longer-dated options (e.g., 90 days or more) have higher Vega

- Short-term options (e.g., 0–7 days) have low Vega but high Gamma

If you’re trading longer-dated options, changes in implied volatility will have a much bigger impact on your P&L. Traders focused on weekly or zero-DTE strategies may think Vega doesn’t matter — but if you’re holding trades over time, Vega becomes critical.

Vega by strike: ATM vs OTM

Not all options have the same Vega.

- At-the-money (ATM) options have the highest Vega

- Out-of-the-money (OTM) and deep in-the-money options have lower Vega

This matters when you’re trading spreads, straddles, or strangles, or doing event-driven trades like earnings plays. One leg may be more affected by volatility changes than the other.

The costly mistakes traders make

Matt sees the same Vega-related errors over and over again:

1. Ignoring Vega entirely

Especially in swing or multi-leg trades. Traders are surprised when the option price moves — not because of Delta or Theta, but because IV changed.

2. Misjudging earnings trades

“Implied volatility can drop 20–30 points after an earnings event. If your option has 10 cents of Vega, that’s a $2–3 move in price.”

Vega + IV crush is often the reason traders lose money on ‘correct’ trades.

Vega vs Gamma: A time-driven trade-off

One of the most insightful moments in the interview is when Matt explains how Gamma and Vega are inversely related across time:

- Near-term options = High Gamma, Low Vega

- Far-dated options = High Vega, Low Gamma

It’s not that the two option Greeks fight each other — they just respond differently to time decay. Smart traders adjust position structure based on trade duration and whether they want to bet on price movement or volatility.

How to track and manage Vega

Most trading platforms display Vega alongside Delta, Gamma, and Theta. But few traders look at it closely.

Here’s what you should do:

- Always check Vega before entering a position, especially if trading earnings or economic events

- Understand how Vega scales in multi-contract or multi-leg positions

- Track changes in implied volatility from entry to exit — and factor that into your expected P&L

Learn more about Vega and implied volatility

Matt recommends two great resources:

🔗 optionseducation.org – A free educational hub by the OIC

📧 options@theocc.com – Email your questions directly to the investor education desk