Ross Young, a high school teacher from New Hampshire, USA, is clear about what is the reason for his options trading success: Consistency is king! For the last years he has traded options in-between classes at the private high school where he teaches Spanish.

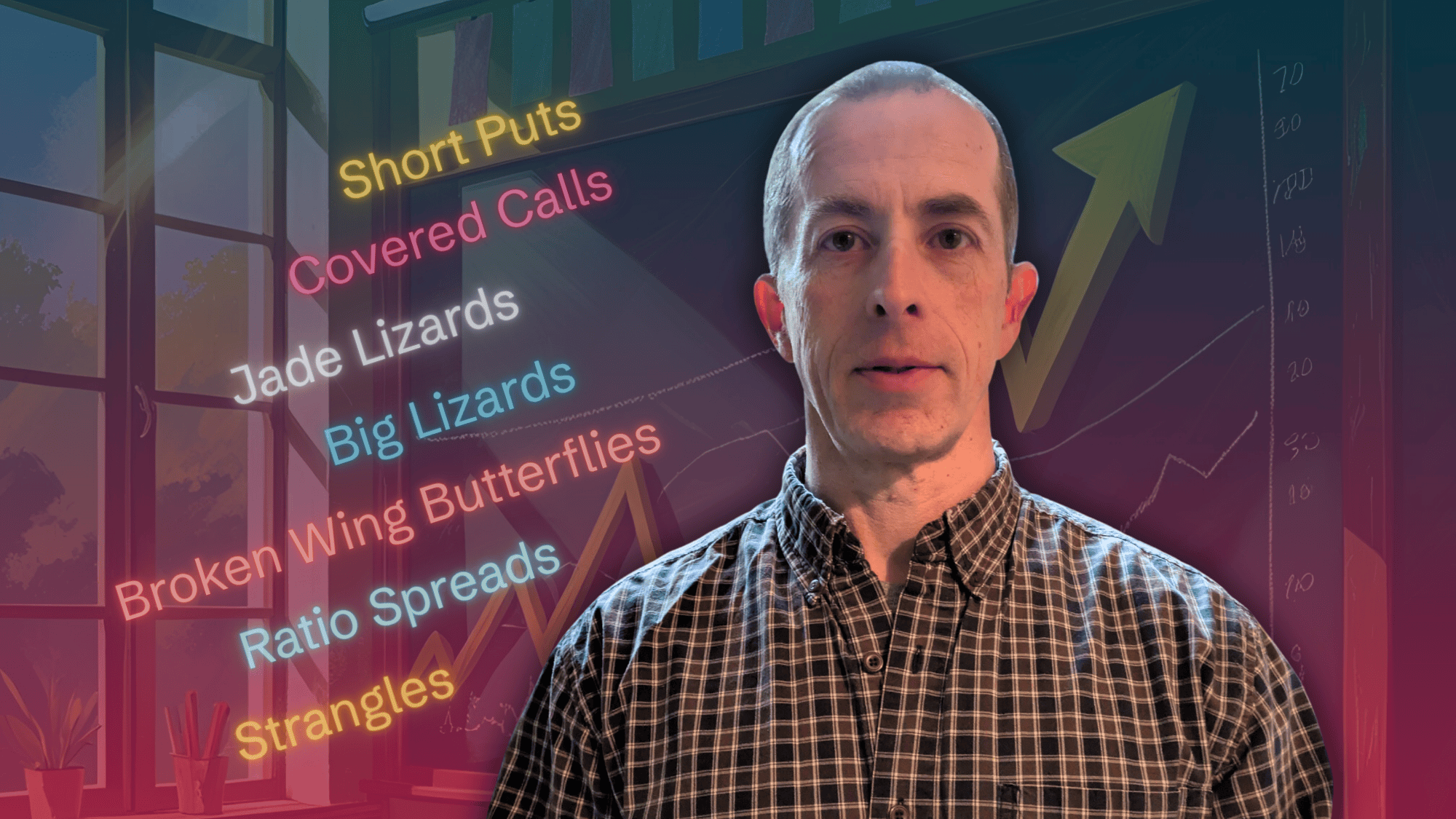

In this interview, he explains his options trading style and risk management, and he shares the six trading strategies that are at the core of his options trading success.

Learn about Ross’ options trading success in this video

The video was produced with Streamyard – an easy-to-use and amazing tool for live streaming and recording.

From classroom to millions: Ross’s trading journey

In this 28-minute Theta Profits interview, Ross Young shares how he turned $500K into $4M through options trading. His journey began in 2016 when he discovered options via Tasty Live’s “Where Do I Start?” series. Initially a passive investor, Ross was drawn to the high-probability strategies of selling options, which became the foundation of his success. Trading between classes, he built a disciplined, consistent approach that led to significant gains.

Consistency is king

Ross emphasizes that “consistency is king” in options trading. He advocates for small, steady wins over risky, high-stakes trades. By focusing on high-probability strategies and managing trades daily, Ross piled up incremental gains that compounded over years. His approach resonates with retail traders seeking sustainable growth without gambling their capital.

Diverse strategies for success

Ross employs a variety of options trading strategies, tailored to different market conditions and underlyings. His favorites include:

- Short Puts: Selling out-of-the-money puts to collect premiums, either taking stock or closing at a preset loss.

- Covered Calls: Selling calls against owned shares to reduce his cost-basis and generate income.

- Jade Lizard: Combining a short put with a call credit spread to create a flexible, no-upside-risk trade.

- Big Lizards: Similar to jade lizards but with short strikes at the same level for higher credit.

- Ratio Spreads and Broken Wing Butterflies: Often used for earnings plays, offering small profits with potential for larger gains if the stock moves favorably.

- Strangles: Selling a short put or short call together. Ross often combines this with shares he owns, creating a covered strangle.

Ross’s diversified approach ensures he’s not overly exposed to any single trade or market direction, making his portfolio resilient. Many of the trades are based on shares he already owns or would like to acquire.

Risk management and portfolio balance

Managing 50 positions at a time, Ross prioritizes risk control. He keeps position sizes small, often starting with one-lot trades to test strategies.

He rolls trades around 21 days to expiration, targeting 1% monthly returns. Ross maintains a long delta bias but includes neutral and short delta positions to survive market downturns. His rule: no single position should jeopardize his portfolio.

The first steps to options trading success

Ross first learned about options trading through Tastylive, and continues to follow their programs. This is also the number one resource he suggests to beginner options traders. He especially enjoyed the “Where Do I Start?” and “From Theory to Practice” programs.

His general advice to beginners is to start small, trade often, and focus on high-probability strategies.

📕 Books recommended in this video

- Julia Spina: The Unlucky Investor’s Guide to Options Trading

- Thomas J. Stanley: The Millionaire Next Door

- Jacob Lund Fisker: Early Retirement Extreme

[…] was able to grow his account from $500K to $4M in a few years trading options in between classes. He previously appeared on Theta Profits and returns to share his favorite trade: the Jade […]